To make this question answerable, let’s start by asking, “How much money is there in actual United States dollars?” Since the statistics for the U.Southward. are easy to come by, we can examine this question in a couple of different ways.

The outset mode to await at it might be, “How much greenbacks is there in U.Southward. currency?” If you took all the bills and coins floating around today in the world and added them all up, how much money would you have? All that hard and easily liquidated currency is known equally the

M0 money supply

or monetary base. This includes the bills and coins in people’s pockets and mattresses, the money on paw in bank vaults and all the deposits those banks take at reserve banks [source: Hamilton]. According to the Federal Reserve, there was $five.eight trillion in the M0 supply stream as of March 2021, the well-nigh recent information available.

That sounds similar an incredible corporeality, but retrieve almost information technology this way: According to the U.Due south. Census, in that location were 332,290,964 people alive in the U.S. in May 2021. If y’all took all the cash and divided it up equally, each person should have about $17,454 in cash on them (or stuffed under the mattress). Patently, there’s some money missing, but there’south an like shooting fish in a barrel explanation for that: The Federal Reserve says that at any given time, between half and two-thirds of the M0 coin stock of U.S. dollars is held overseas.

The residuum of the money is in banking concern accounts of various types, and the Federal Reserve has tracked these funds in three dissimilar values known as the

M1,

M2

and

M3

coin supplies. (M3 has since been dropped. More on that below.)

M1

represents all the currency exterior the U.Due south. Treasury, Federal Reserve banks and the vaults of depository institutions. It also includes need deposits at commercial banks (excluding those amounts held by depository institutions, the U.South. government, foreign banks and official institutions), the Federal Reserve bladder and other liquid deposits. In March 2021, the M1 money supply for U.Southward. dollars equaled about $18.7 trillion [source: Federal Reserve].

M2

is the M1 supply, plus minor-denomination time deposits (less than $100,000). In March 2021, the M2 money supply was about $19.9 trillion [source: Federal Reserve].

M3

is M2 plus larger CDs. As of March 2006, the Fed stopped tracking the M3 coin stock as an economical indicator because it felt it did non add any information on economic action that was not already bachelor from M2 [sources: Federal Reserve].

All told, anyone looking for all of the U.S. dollars in the world in May 2021 could expect to detect approximately $19.9 trillion in existence, using the M2 coin supply definition. If you just want to count the value of notes and coins, there are about U.South. $two.1 trillion worth of notes and coins floating around the globe [source: Federal Reserve].

Merely suppose you lot wanted to know the actual number of notes in circulation, rather than how much they were worth? At the end of 2020, the Fed estimated there were 50.3 billion notes (ranging from humble $one bills to mighty $ten,000 bills) in apportionment. This information is updated annually.

So, now that we accept figured out the U.S. money supply equally much as we tin, what almost the rest of the world?

The Difficulty of Tracking Cold, Hard Cash

Peter Dazeley/Getty Images

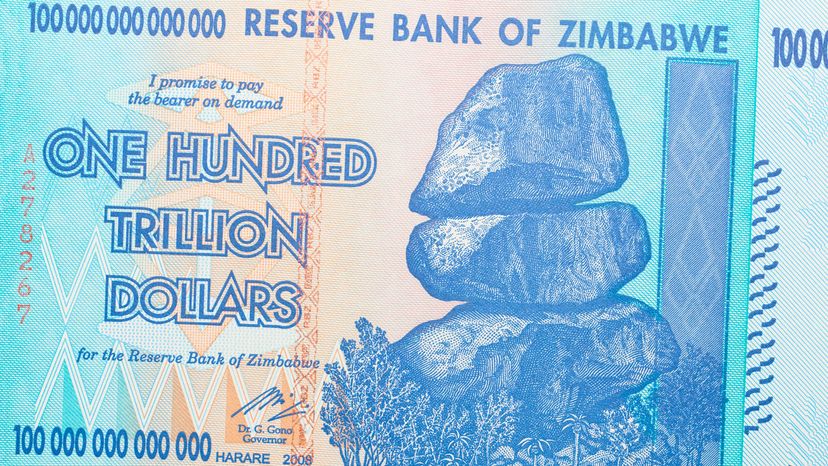

When a federal authorities finds itself in a demark, information technology’s commonly tempted to mint its way out of trouble. While printing coin can solve many spending bug in the brusque term, it tends to present enormous long-term problems. The Zimbabwean dollar is an excellent example of this miracle.

In 2000, an exodus of much of Zimbabwe’s labor pool led to a collapse of the state’s financial system. To support public project spending, the government finance ministry printed surplus Zimdollars — too many, in fact. Economically speaking, coin is like any other article: It loses its value when there’s an abundance of it. A surplus of readily available money in apportionment leads to inflation, where money has less purchasing power. In the start decade of the 21st century, Zimbabwe’s economy entered

hyperinflation. Economists watching the startling loss of value of the Zimbabwe dollar estimated that it was losing value and so speedily that its decline was equivalent to prices doubling in stores every 1.3 days. This puts the annual aggrandizement rate Zimbabwe experienced by the cease of 2008 at 516,000,000,000,000,000,000 (quintillion) per centum, the highest in the world [source: Berger].

The Zimbabwean government decided to fight fire with fire and printed even more money in higher denominations. Eventually, the land would produce a $100 trillion Zimbabwean dollar note — which had an exchange charge per unit of about $thirty (U.S.) in January 2009 and $5 in 2011. By 2015, it was worth just 40 cents [sources: BBC, McGroarty and Mutsaka, CNN]. The authorities would go on to abandon its currency entirely, opting instead to adopt the U.South. dollar and South African rand equally official currencies.

But what near all those trillion-dollar notes that the country’s finance ministry building produced in 2008? The authorities never collected the bills or permit people commutation them, so no one knows the final tally in circulation. Indeed, the bills have get something of collectors’ items, and traders have stockpiled many, as they can fetch higher prices than what they were officially worth [source: McGroarty and Mutsaka].

Since and so, Republic of zimbabwe reintroduced its ain currency in 2019, merely the state has been battling high inflation rates and foreign currency and food shortages. The local unit, which was supposed to be equal to the U.S. dollar, dropped to 84 cents per USD [source: Ndlovu].

Zimbabwe has shown how difficult it can be to keep runway of how much money a unmarried nation has in the global markets, let solitary how much money at that place is in the world. However, this inherent difficulty hasn’t stopped some from trying. Mayhap the closest gauge to how much money exists in the earth was released by Jeff Desjardins, the editor-in-master of Visual Backer in 2015 and updated in 2020. Desjardins added up all the world’s silver, gilded, acme stock exchanges, cryptocurrencies and much, much more and came out with the amount of about $2.7 quadrillion. This is what that looks like written out: $2,745,319,000,000,000. That’s a lot of moolah. He estimated the value of all the coins and bank notes in the world at $6.half dozen trillion.

Things would be a lot easier on Desjardins and foreign exchange market place analysts if there was merely a single currency used by every state on the planet. So why don’t we?

Pros and Cons of a Universal Currency

The concept of a single worldwide currency has been suggested since the 16th century and came close to being instituted afterward Earth State of war II — still the idea remains niggling more than that. Proponents argue that a universal currency would mean an finish to currency crises like Zimbabwe’s. A single currency wouldn’t exist subject to commutation rate fluctuations because there would be no competing currencies to commutation against. In other words, a universal currency would lose its value as a commodity bought and sold on open markets and would take value only for its worth in buying other commodities. To put it plainly, money would become only money. Its purchasing power would be the result of the aligning of involvement rates and other monetary policy tools in response to aggrandizement or deflation.

Who would be responsible for adjusting those interest rates, though?

I of the chief fears among opponents of a universal currency is the creation of a central body formed to oversee the monetary policy for a single world currency. An extant international trunk, the United Nations (U.N.), provides an example of the potential pitfalls and strengths a key global monetary body could await. Successes like peace-edifice missions in nations every bit disparate every bit El Salvador, Mozambique and the former Yugoslavia attest to the power a unified international torso can have to resolve conflict. On the other side of the coin, the U.N.’s Intergovernmental Panel on Climate change (IPCC) is widely accused of replacing scientific discipline with diplomacy, equally nations responsible for contributing to climate change aren’t openly taken to task in IPCC reports.

These reasons and others keep to forestall the adoption of a universal currency. Perchance closer on the horizon is the integration of divide currencies within regions into unified currencies. This has already occurred in some areas. The virtually famous case is the euro. As of 2021, 19 countries in Europe use the euro instead of their local currencies. Some of the benefits of using the euro are that it makes information technology easier to compare prices between countries and easier, cheaper and safer for businesses to buy and sell inside the euro area and to merchandise with the rest of the earth. At the aforementioned fourth dimension, there are meaning disadvantages. For example, a debt-laden state is no longer able to devalue its ain currency to make its goods more than attractive to buyers from other countries. The financial troubles of countries like Greece and Spain over the last decade were exacerbated, some experts say, past the fact that they use the euro [sources: Schoen].

The euro is not the only example of a shared currency. Eight West African nations share a common currency, the Due west African CFA franc, which was introduced in 1945 (at the time CFA stood for “Colonies Francaises d’Afrique” or “French Colonies in Africa”). A further six Primal African countries utilize the CFA franc, equally well, though the meaning of the initials has changed. It now stands for “Communaute Financiere Africaine” (“African Financial Community”) in W Africa and “Cooperation Financiere en Afrique Centrale” (“Financial Cooperation in Central Africa”) in Fundamental Africa. This currency was renamed the eco in 2019 and is pegged to the euro, just implementation has been delayed because of the coronavirus pandemic [source: CNBC].

In 2008, Central American nations agreed to create a single currency for the region, but equally of 2021 it has not happened. Instead, every Central American state, with the exception of Costa Rica, accepts the U.South. dollar, although they all accept their own currencies except for El Salvador [sources: VisitCentroAmerica, Fundamental America Data]. Meanwhile, the Union of South American Countries put the brakes on their own common currency project in 2011, citing the experiences it observed with the European Matrimony and the euro [source: MercoPress].

Originally Published: Sep 8, 2009

How Much Coin Is In The World FAQ

How much money exists in the earth?

Information technology’south not an easy question to reply. It depends on whether you’re just talking about currency or other things every bit well. According to estimates, all the money in circulation is worth vi.6 trillion U.S. dollars. This is actual, concrete money that’southward available in currency notes and coins.

How much money is in the United States?

According to estimates from March 2021, the total corporeality of physical currency in the U.S. is $2.i trillion.

How much is the world worth?

According to calculations made by an astrophysicist, the full worth of the globe is effectually $five quadrillion dollars, which too makes world the most expensive planet in our solar system.

How much coin is in the UK?

According to the Banking concern of England, there is effectually 4.5 billion notes worth £80 billion or U.S. $113 billion, currently in circulation in the United Kingdom.

How many trillionaires are at that place in the world?

At that place are no trillionaires in the world as of May 2021. However, co-ordinate to estimates, information technology is possible that Jeff Bezos might reach this status by 2026.

Lots More than Information

Related Articles

- How the Fed Works

- How Banks Work

- Why Is the U.S. Dollar the World’s Currency?

- If you took all of the gold in the earth and put it in one place, how much would in that location be?

- How Currency Works

- How Exchange Rates Work

- What do the symbols on the U.S. $1 bill mean?

- Why are the penny and the nickel the only U.Due south. coins with images that don’t face left?

Sources

- Aboa, Ange. “West Africa renames CFA franc just keeps it pegged to euro.” Reuters. Dec. 21, 2019. (May 15, 2021). https://www.reuters.com/article/u.s.-ivorycoast-french republic-macron/westward-africa-renames-cfa-franc-simply-keeps-it-pegged-to-euro-idUSKBN1YP0JR

- Berger, Sebastien. “Zimbabwe hyperinflation ‘volition set record within vi weeks’.” The Telegraph. Nov. 13, 2008. (July xvi, 2013) http://www.telegraph.co.united kingdom of great britain and northern ireland/news/worldnews/africaandindianocean/zimbabwe/3453540/Republic of zimbabwe-hyperinflation-will-set-globe-tape-inside-6-weeks.html

- Lath of Governors of the Federal Reserve. “Money Stock Measures – H.6 Release.” April 27, 2021. (May 15, 2021). https://www.federalreserve.gov/releases/h6/electric current/default.htm

- Lath of Governors of the Federal Reserve. “Releases.” March 9, 2006. (May 15, 2021). https://www.federalreserve.gov/releases/H6/20060309/h6.txt

- Central America Data. “Single currency for Central America to be analyzed” Dec. 8, 2008 (July 16, 2013). http://archive.is/is7G

- CENTROAMÉRICA. “National currencies of Cardinal America.” (May 15, 2021). https://www.visitcentroamerica.com/en/interest-information/currencies-in-central-america/

- Desjardins, Jeff. “All of the World’s Money and Markets in One Visualization.” Visual Capitalist. May 27, 2020. (May fifteen, 2021). https://world wide web.visualcapitalist.com/all-of-the-worlds-coin-and-markets-in-one-visualization-2020/

- Desjardins, Jeff. “All of the World’s Money and Markets in One Visualization.” Visual Backer. Dec. 17, 2015. (May 15, 2021). http://money.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization/?link=mktw

- Hamilton, Adam. “Large inflation coming 2.” Zeal. June 5, 2009. http://www.zealllc.com/2009/biginf2.htm

- McGroarty, Patrick and Mutsaka, Farai. “How to turn $100 trillion into five and feel good almost information technology.” Wall Street Journal. May eleven, 2011 (July xv, 2013). http://online.wsj.com/commodity/SB10001424052748703730804576314953091790360.html

- MercoPress. “Unasur, looking at the Eu, freezes project for common currency and primal bank” June thirteen, 2011. (July 16, 2013) http://en.mercopress.com/2011/06/13/unasur-looking-at-the-eu-freezes-project-for-common-currency-and-central-bank

- Ndlovu, Ray. “Bank Fines, Suspensions Weighed by Zimbabwe for Currency Gouging.” Bloomberg. April 15, 2021. (May 15, 2021). https://www.bloomberg.com/news/articles/2021-04-15/bank-fines-suspensions-weighed-by-zimbabwe-for-currency-gouging

- Schoen John Westward. “What if the globe all used the aforementioned currency?” (April 6, 2009) NBC News. http://www.nbcnews.com/id/30047877/ns/business organization-answer_desk/t/what-if-world-all-used-same-currency/#.UebpsG3Nm6n

- United states of america Census Bureau. “U.Southward. and Earth Population Clock.” May one, 2021. (May 15, 2021). https://www.census.gov/popclock/

- Your Europe. “Which countries use the euro.” (May 15, 2021). https://europa.eu/european-matrimony/about-eu/euro/which-countries-use-euro_en

- Your Europe. “Benefits of the euro.” (May 15, 2021). https://europa.eu/european-spousal relationship/about-eu/euro/benefits_en

Source: https://money.howstuffworks.com/how-much-money-is-in-the-world.htm

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media