USD Coin (USDC)

USD Money is a stablecoin which is pegged to the US dollar. It is managed by Circumvolve and Coinbase.

| Marketplace Cap | Volume 24h | Circulating Supply |

|---|---|---|

| $55,427,476,040 | $ii,377,289,552.29 | 55546939563.0 USDC |

What is USD Coin?

USD Money (USDC) is a relatively fresh stablecoin pegged to the US dollar. Information technology was launched on September 26, 2018, in collaboration between Circle and Coinbase. USDC is an alternative to other USD backed cryptocurrencies like Tether (USDT) or TrueUSD (TUSD).

In a nutshell, USD Coin is a service to tokenize US dollars and facilitate their use over the internet and public blockchains. Besides, USDC tokens can be changed back to USD at whatsoever fourth dimension. The execution of issuing and redeeming USDC tokens is ensured with ERC-20 smart contract.

Bringing US dollars on the blockchain allows moving them anywhere in the world within minutes, and brings much-needed stability to cryptocurrencies. Also, it opens up new opportunities for trading, lending, risk-hedging and more.

Who is the Team Behind The USD Coin?

USD Coin is adult past the Centre consortium, a partnership between Circumvolve and Coinbase. The technology and governing framework are developed by Middle, while Circle and Coinbase are the first commercial issuers of USDC.

Circle was founded in 2013 by the entrepreneurs Jeremy Allaire and Sean Neville.

Circle is an official Money Transmitter, which makes the visitor an open fiscal book. Money Transmitters are US money service businesses that must comply with federal laws and regulations. Earlier the issuance of USDC, the equivalent amount of USD is with 1 of Circle’s accredited partners. Consequently, all USDC tokens are regulated, transparent and verifiable. Besides, Circle is known as the crypto startup backed by Goldman Sachs.

How Does USD Money Piece of work?

USD Coins aren’t just being printed out of thin air. Circumvolve guarantees that every USDC token is backed with a single US dollar. The process of turning US dollars into USDC tokens is called tokenization.

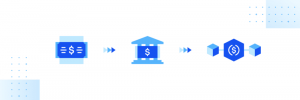

Tokenizing USD into USDC is a three-step process:

ane) A user sends USD to the token issuer’s bank account.

ii) The issuer uses USDC smart contract to create an equivalent amount of USDC.

iii) The newly minted USDC are delivered to the user, while the substituted Usa dollars are held in reserve.

Redeeming USDC for USD is as easy every bit minting the token, except the procedure is reversed:

1) A user sends a asking to the USDC issuer to redeem an equivalent amount of USD for USDC tokens.

2) The issuer sends a asking to the USDC smart contract to exchange the tokens for USD and take an equivalent corporeality of tokens out of the apportionment.

3) The issuer sends the requested amount of USD from its reserves back to the user’s banking concern account. The user receives the net corporeality equivalent to the one in USDC tokens, minus all incurred fees).

Different the most pop stablecoin Tether (USDT), creators of the USD Money are obligated to provide total transparency and work with a range of financial institutions to maintain full reserves of the equivalent fiat currency.

All USDC issuers are required to regularly report their USD holdings, which are so published by Grant Thornton LLP. All the monthly attestation reports tin can be found here.

How to Utilise USDC

USD Coin (USDC) is a one:ane representation of ane Usa dollar on the Ethereum blockchain. It’southward an ERC-twenty token and can be used with every app which supports the standard.

To tokenize or redeem USDC with Circle, you need to register an business relationship, verify your identity (KYC), and link a legitimate bank account. Circumvolve USD platform allows users to perform iv core actions:

- Tokenize USD;

- Redeem USDC;

- Transfer USDC out to ERC20 uniform Ethereum addresses;

- Deposit USDC from external Ethereum wallet addresses.

Circle USDC doesn’t accuse users any fees for tokenizing and redeeming services, except there is a $l commission for incorrect and rejected bank transfers. For Coinbase USDC operations, all the standard fees apply.

A minimum USDC redemption amount is 100 USDC. The tokens are processed on concern days simply, and the process tin take up to 24 hours.

There’s no minimum tokenization amount, and the process can take upwards to 2 business organisation days.

In general, stablecoins like USDC are used to:

- Short cryptocurrencies without cashing out and get in easier to buy cryptocurrencies in the future;

- Avoid traditional financial instruments and institutions;

- Avoid hyperinflation (for people living in countries like Venezuela or Turkey);

- Send coin instantly, globally, deeply and at depression cost;

- Purchase items in various crypto dApps, exchanges, and blockchain-based games.

How is The USDC Coin Different From Other Stablecoins?

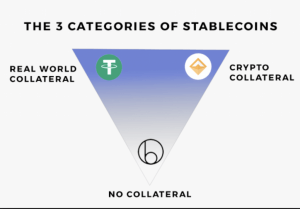

Crypto stablecoins can exist put into four categories:

-

Fiat-collateralized.

These include all stablecoins pegged to reserved fiat value. All fiat-collateralized coins are centralized by blueprint.

Examples: Tether (USDT); TrueUSD (TUSD); Gemini Dollar (GUSD); Paxos Standard Token (PAX); Digix Gilt (DGX); USD Money (USDC). -

Crypto-collateralized.

These are stablecoins whose value is pegged to reserved crypto avails.

Examples: Makercoin (MKR & DAI); Havven (nUSD & HAV). -

Algorithmic not-collateralized.

Software-based economic models that seek to provide price stability without any collateralized assets.

Example projects: Ground; Kowala; Fragments. -

Hybrid.

Stablecoins which rely on a blend of the approaches listed above.Example projects: Carbon.

USD Coin falls into the first, fiat-collateralized coins category, and is a centralized stablecoin. In general, all the projects within the same category work in a similar fashion and take only minor differences. The more outstanding ones are Tether (USDT), known for refusing to conduct a genuinely transparent audit, and Digix Gilt (DGX), whose value is pegged to gold.

The balance fiat-collateralized stablecoins release regular attestations and are backed past The states dollars. The main differences between them circumduct around their fee policies and different partner organizations, but the business concern model, for the most part, stays the same.

Where Can You Go USD Money?

USD Coin (USDC) can exist purchased in the post-obit exchanges:

-

Binance

(paired with BTC, BNB). -

Poloniex

(paired with BTC, ETH, XRP, BHC, STR, LTC, ZEC, XMR, DOGE). -

Coinbase Pro

(paired with BTC, ETH). -

Coinbase

(paired with -

CoinEx

(paired with USDT). -

Coinsuper

(paired with BTC, USD). -

OKEx

(paired with BTC, USDT). -

CPDAX

(paired with BTC). -

Hotbit

(paired with USDT). -

Kucoin

(paired with BTC, ETH, USDT). -

Korbit

(paired with KRW). -

FCoin

(paired with USDT). -

LATOKEN

(paired with BTC, ETH). -

SouthXchange

(paired with BSV, DASH). -

COSS

(paired with BTC, ETH). -

Crex24

(paired with USD).

Too these exchange pairs, USDC can exist turned to USD and vice versa at Coinbase.

Where to Store USD Coin

USDC is an ERC-twenty token issued on the Ethereum blockchain and tin can be stored in any Ethereum wallet. The most popular options are MyEtherWallet, MetaMask, Mint or Jaxx wallets. If you lot don’t know how to set up up an Ethereum wallet, see this quick guide.

Electric current State of the Project

USD Coin is a rapidly developing project with credible institutions behind it. Since the project proclamation in May 2018, its ecosystem has already expanded to more than 60 partners.

Some of the latest news surrounding the USDC project is about the level of control projection creators retain over the stable cryptocurrency. Plain, the developers hold the right to blacklist addresses and freeze funds if there’southward any suspicion that the USD Coins are used for illegal activities.

Even so, most of the other stablecoins besides take similar clauses. The simply stablecoin without such terms is DAI by Maker.

Similar Projects

-

Tether

(USDT).

The oldest and most popular USD-backed stablecoin. -

TrueUSD

(TUSD).

USD-backed ERC-xx token by TrustToken Platform. -

Gemini Dollar

(GUSD).

USD-pegged ERC-20 token issued past Gemini commutation. -

Paxos Standard Token

(PAX).

An ERC-twenty token pegged to the US dollar. -

Dai

(DAI).

ERC-twenty stablecoin pegged to the USD. -

bitCNY

(BITCNY).

A stablecoin issued on BitShares blockchain and backed by Chinese Yuans (CNY). -

bitUSD

(BITUSD).

A stablecoin issued on BitShares blockchain and backed past USD. -

bitEUR

(BITEUR).

A stablecoin issued on BitShares blockchain and backed by Euros (EUR). -

Stasis Eurs

(EURS).

A collateralized ERC-xx stablecoin pegged to the EUR. -

nUSD

(NUSD).

An ERC-20 stablecoin issued by the Havven foundation. -

White Standard

(WSD).

A USD-pegged stablecoin for global payments issued on Stellar protocol.

Source: https://cryptonews.com/coins/usd-coin/

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media