I’ve been getting questions almost the “ID Coin” teaser out of Stansberry for several years now, and I did briefly comment on it style dorsum in 2018 when I was buying a stock that I think they were also teasing using this “ID Money” spiel… but I didn’t get very detailed or write a full teaser solution article virtually it, mostly because in that location wasn’t a 100% certain answer, and the questions continue to pile up, fueled past the clamorous greed stirred up by those promos.

And, of course, the wild enthusiasm for all things cryptocurrency-related has caused Stansberry to double down on this promo in recent months, and readers continue to get ever more excited about it.

So… what’s the story?

Well, it’s somewhat of a allurement and switch… the implication of the teaser advertising is that there’due south one “ID Coin,” which yous might interpret every bit being some actual cryptocurrency or blockchain projection, and y’all can purchase it to own a piece of this future of better identity management and secure ID cards and a glorious Estonia-similar digital life for Americans.

But the “ID Coin” in the pitch, actually, is more of a metaphor. It represents the idea that there will be a new identity system for the US, probably based some how on blockchain technology, and that information technology will supercede social security cards and do away with identity theft and modernize information privacy and data access for all of united states of america… equally has been done, to some degree, in lots of other countries.

Afterward all, information technology’south not easy to take a worse system to underly your national ID system than a 9-digit number, assigned at birth and printed on a paper card.

I call up sending my Social Security card through the washing machine when I was a teenager, and I idea my life was over… picayune did I know, by the time I became an adult there would be thousands of people selling my social security number to anyone who might want it. I could accept bought 1,000 new ones for $50 if I had been patient and waited for the internet to be commercialized, and to exist chop-chop followed by the invention of cybercrime.

But anyway, this pitch, though very like to ane I mused a little bit about 3 years ago, continues to raise questions… so permit’s skim through and pull out a few highlights to think nigh, shall nosotros? This is now an entry-level pitch, befitting its age and mass appeal, and it’southward being used to sell John Engel’s

Stansberry Innovations Study

($49 starting time year, renews at $199).

This is from the order course:

“This technology could be 100x bigger than any crypto… token… or similar applied science to engagement .

“That’s why, in the coming months, I predict the news volition be total of stories of traders, businesses, funds, and mom and popular investors desperately trying to get a stake in ID Coin technology.

“Past so, you could already take had the chance to encounter hundreds of percent gains on the ID Coin investments we’re sharing with y’all today – simply like with Bitcoin’s astronomical ascension from pennies to over $18,000.”

And, of course, the temptation…

“You can invest in ID Coin technology right now – through whatever ordinary brokerage business relationship….

“The key affair is: You accept to get in now.

“Frankly, it’s the next best affair to time traveling back to 2010 and ownership Bitcoin for a nickel.”

Then what are they talking about? Again, we get a petty conceptual in this extended metaphor…

“You see, using ID Money technology is not the same thing as actually owning a stake in information technology.

“Just like existence an early on user of Amazon or Google wouldn’t have paid y’all a dime.

“Simply if you understood what was coming… Google shares could have made yous more than than 30 times your money.

“And Amazon… a staggering 1,600x return – enough to turn every $five,000 into more $8 million.

“That’due south why, once you understand ID Coin’south potential, you lot’ll realize you lot nonetheless haven’t missed the well-nigh important quantum in the crypto engineering space.”

Are

y’all

getting our gratis Daily Update

“reveal” emails? If not,

just click here…

OK, so that’s more of a generic “invest in cryptocurrency leaders” notion. What else? Is this a pitch for bitcoin itself?

Not so much…

“The reality is: Governments hate Bitcoin and have tried everything to keep it from going mainstream. It could take away their command of the monetary system.

“Only with ID Coin applied science – it’s just the opposite. This applied science volition save them trillions of dollars… and end the threat of cyberattacks from enemies similar Communist china… Islamic republic of iran… and Democratic people’s republic of korea.

“After all, this technology could end hacking and provide a secure identity to every person on Earth in the next ten years.”

So why haven’t we heard most this mythical “ID Money?” There’southward always an respond to those logical “roadblock” questions, that’s copywriting 101:

“Of grade, with national security on the line… the U.S. government is saying as footling every bit possible about ID Coin for now.

“Which is why you’ll rarely see any mention of ID Coin in the mainstream press.”

And the hope of a rapid change is just about the same every bit the promises they made in the first version of this pitch, three years ago:

“Now, ID Coin is just starting to get more attending.

“Simply the biggest breakthrough volition come when the U.Due south. government officially adopts ID Coin technology and rolls information technology out to every American citizen equally a new and ameliorate form of the Social Security number.

“The procedure is already underway. Although most people haven’t noticed withal.

“In September 2020, Congress moved forward with a bipartisan beak aimed at ‘improving digital identity.’”

Await, something real is happening now? What do they mean?

“Information technology gives the Treasury Secretarial assistant, Homeland Security Secretarial assistant, and the Commissioner of Social Security less than a yr to come up with a plan to set our identity theft crisis and quite peradventure get rid of Social Security Numbers birthday.

“In brusk: To begin rolling out ID Coin to every American.

“It got lost in all the anarchy of the pandemic and the election, just make no mistake:

“Congress is telling us exactly what it plans to practise.”

Really… “lost in the chaos,” you say? I gauge that’s one way to describe a nib that had simply four sponsors and didn’t go anywhere… and wasn’t much more than than a toe in the water, anyway. Here’due south some more from the pitch:

“… the Treasury Department’s website has chosen ID Coin ‘one of the near disruptive innovations since the appearance of the internet.’

“Simply the near of import goad could be House Bill 8215, which I mentioned before.

“Feel free to jot that number downwardly and go on a close eye on what the new Congress does.”

That number no longer means anything, of course, numbers reset with a new Congress and that was from the waning days of the 116th Congress. We’re moving on in the 117th Congress, and this specific bill has not yet been introduced again — maybe information technology will be, but not yet. The original sponsor was Nib Foster, from Illinois, and he was reelected but has not filed a new bill on this matter. He did sponsor H.R. 2211, to direct the Fed to report central bank digital currencies, merely there hasn’t been much that’s ID-related or cryptocurrency-related yet in the new Congress — and most ID or blockchain mentions in bills and then far seem to relate to the latest fights over voting that typically follow close elections — requiring IDs, vote security, voting technology, federal oversight of state elections, etc.

There’s some more chatter from the pitch that makes it seem like a solution to our identity theft and cybersecurity problems is just around the corner, pending a stroke of some authorities pen…

“

“As Bob Stasio, former chief of operations at the National Security Agency’s Cyber Operations Eye told Bloomberg:

“Your digital Deoxyribonucleic acid fingerprint will be “mathematically incommunicable” to indistinguishable.

“Even the U.South. military’s ultra-hugger-mugger research arm DARPA (inventor of the Cyberspace) is planning to utilize this aforementioned technology to secure our nuclear arsenal.”

That quote comes from a 2017 article in

Bloomberg, which is worth a read, and is actually mostly about the risks of continuing to rely on Social Security numbers, with the angst and the Congressional hearings at the fourth dimension inspired by the big Equifax hack. It’s a good commodity, and it does mention the possibility of using some kind of blockchain-based cryptographic hash number to supercede the social security number and give users some control over what data is made available to various people, including a mention of the oft-cited ID technology used by Estonia, but that’due south not at all a way to say that there’south a detail existing cryptocurrency or engineering that would have this function — in that location isn’t.

Maybe at that place will be someday, but government moves SLOW… and imagine what the argue would exist similar if the President today proposed a new national ID carte du jour that provides access to all of your information — even if it would be safer and improve, we all know that trust in regime has been declining precipitously in the past few years and a technically circuitous and long-term thing like revamping national ID systems would nigh certainly create a HUGE battle. Then imagine what would happen if direction of this new ID system was granted as a sole source contract to some IT company. I don’t even know what side I’d be on in this theoretical time to come debate, merely I’1000 sure I’d be manipulated by social media, my friends, and the news to intendance very deeply and believe that the other side, whichever one information technology might be, is a agglomeration of jack-booted authoritarian thugs.

So that’s the general promise of the ad… blockchain technology is going to atomic number 82 to better ID management, and a new ID system for the Us (or in the farthermost visions, a whole new infrastructure for the internet that does away with hacking and cybercrime), and information technology’due south going to sneak up on united states before nosotros see it coming, and somehow that volition make you rich.

And we’re told that you don’t accept to buy any cryptocurrencies or set up 1 of those inscrutable digital wallets, or anything like that… you can do it through your broker.

So yes, as was the case dorsum in 2018… the middle of this “ID Coin” pitch is really probably as simple equally, “Buy shares of something that will benefit from the rise employ of blockchain.”

Permit’southward dip our toes a little further into the pitch, just to run across if there’due south annihilation else to note:

“Hacking will be a thing of the past… thank you to a make-new crypto-based innovation I call “ID Coin”… with a massive, $half-dozen trillion market potential.

“Incredibly, ID Coin is built on engineering that already exists.

“Equally Jerry Cuomo, a vice president at IBM working on ID Coin technology, put it:

‘Imagine a world where y’all are in direct control of your personal information; a globe where you can limit and control how much information yous share… This is self-sovereign identity, and it is already hither.’”

That’s actually a quote from a Techcrunch article that cites some good reasons why there

won’t

exist a single ID platform that uses a public blockchain, it’s worth a read.

And it’south also a reminder that most of this pitch is one-time… information technology started circulating dorsum in 2018, most of the articles cited or quoted are from 2017, though they have gone in and updated some things (the charts they testify for gains in Palo Alto Networks (PANW) and Fortinet (FTNT) go into the Autumn of 2020).

My conclusion the first fourth dimension I looked at this pitch was that they were very likely teasing shares in Okta (OKTA), a cloud provider of “Identity as a Service,” as their master play on this metaphor of an “ID Coin.” Self-serving, since that is as well a company I was starting to build a position in 3 years ago, too, and I could exist wrong — they exercise as well include Okta now in the example charts of past winners that are “outset generation” programs, and say this most Okta and the other companies popped in as examples…

“ID Coin and its sophisticated, hacker-proof cybersecurity technology will do far more than any of these “first generation” programs.

“It will essentially brand passwords, databases, and traditional cybersecurity obsolete.

“Peradventure that’s why 61% of companies say they program to utilize some grade of ID Coin applied science.”

So that indicates maybe they’re

not

highlighting Okta as a choice for this theme any longer. I don’t know when Stansberry beginning recommended Okta, just it’s cited as one of their holdings in complimentary commentaries as early as February of 2018, so they bought it before I did (I started buying in March of that twelvemonth). If they bought it in, say, late 2017 to give six months or so for the stock to settle after the IPO, so yeah, they would have big gains and also could have been stopped out at some bespeak. This is a quote from the ad:

The elementary reality is: Nosotros believe one early investment in this tendency could brand you substantial money in the coming years.

In fact, my firm’south very kickoff recommendation for investing in this space has already shot upward nearly 585% – before any of this data has fifty-fifty gone mainstream.

OKTA would be sitting on roughly 585% gains as of last Fall, if you had bought it in the fall of 2017. I paid a little more, my starting time buy was effectually $37, so even afterwards the stock has surged quite a bit college over the by several months I’grand still “only” in the neighborhood of those 600% gains, too. It’s quite an incredible company, specializing in identity direction that tin can help connect people through all the different products and services they demand through a unmarried login, and their Okta conference, including some additional cybersecurity production introductions, particularly access for privileged users, was well received this week and helped to heave the shares a little more… only it certain ain’t cheap. The company should become assisting probably side by side year, if all goes to plan, but currently, with a $34 billion market cap, is valued at 40X trailing revenues… even with forty% revenue growth, it could have time to “grow into” that kind of valuation. At this point, I’d demand to see a large dip to purchase more — we almost got there terminal calendar month, but it bounced dorsum pretty strongly.

And so what else might they be talking virtually?

They notwithstanding pull out the example of Republic of estonia, which not just has a universal ID organization that attaches to all their central records (health, voting, ATM, land titles, etc.), simply also sells these IDs (which are just cards and a couple pivot numbers, not annihilation specifically blockchain-driven) for people who want “eastward-residency” in Estonia and the Eu….

“95% of Estonians file their tax returns online each year. It takes exactly 3 minutes.

“All thanks to ID Money.

“It’s all they demand, and information technology can’t exist hacked.”

And then it’s very clear, this is a pitch about the concept of college-security and mayhap blockchain-enabled IDs and identity security and direction… it’due south Non a pitch of a particular “ID Coin.” There is no “ID Coin” as they tease it, it’due south more of a metaphor. A fashion to brand the complicated technologies and competing systems that aim to provide better and more secure identification seem like they’re as simple as a “token” that you can buy to get rich. That’s not how it works.

Really, what nosotros’re dealing with is the potential for the government to aid coordinate a arrangement that is less dependent on (extremely insecure) Social Security numbers as a national ID, and for business concern to amend technologies for identity verification. This is all happening pretty constantly, in a continuum of advocacy (going from Pivot codes to double verification to authenticator apps and one-time codes and biometric confirmation from face ID or fingerprints), and no one company or person owns it.

And, not to put also fine a point on it, but Estonia didn’t actually use blockchain much for its due east-Estonia projects, and most of the applied science underlying Estonia’s emergence equally a technological utopia of sorts predated Satoshi Nakamoto and Bitcoin. Well, OK, some of the things going on in Estonia do use blockchain technologies, or similar cryptographic systems, to help various Estonian databases talk to each other… merely information technology’s not similar all of Estonia lives harmoniously using a single blockchain crypto network to protect all their individual information.

It’s not simply Estonia, of course, pretty much everybody has meliorate ID systems than the Usa government..

“India has four times the population of the United States… and less than one-eighth of our per capita Gdp.

“Even so India has already rolled out its version of ID Coin to more than 1 billion people, including 99% of adults over the age of 18.”

That’s a reference to Aadhaar, India’s offset national identity card program. Yes, it has been a huge success in that information technology has brought IDs to hundreds of millions of people who didn’t have them, tracking welfare and government service payments, bringing the very poor into the economy and eventually the banking organisation, and help to shrink public benefit fraud and “theft by bureaucracy.” It’s basically just an ID card like any other, though the ID number is connected to biometric data (iris scan and/or fingerprint) that tin can verify individual IDs. It has nil to exercise with blockchain.

There are indeed lots of experiments underway to meet how blockchain-inspired or blockchain-enabled ID systems might work, though, again, we’re non talking about a public ledger blockchain or the apply of whatever current cryptocurrency system or token — nosotros’re talking nearly new systems, built by governments and banking systems, that utilise blockchain engineering.

Blockchain and most cryptocurrencies are not surreptitious, they are for the most office open source software that nobody owns, not even the people who use them or purchase the tokens (that’s office of what makes valuing them a claiming, at least for fuddy-duddies like me)… and we don’t need blockchain to brand our current national ID system dramatically better or less hackable — technology for improving and verifying IDs in a way that surpasses the Social Security number has been around for generations now, and, frankly, even a simple credit card-like device with a pivot, like Estonia uses, would be a vast improvement. That doesn’t mean it has to employ blockchain specifically (it might, it might not, I have no idea, but blockchain is not the just path to meliorate security and amend ID management).

But we’re talking about money and investments hither, so what on world does John Engel call back you lot should buy?

One terminal bit of info…

“Keep in heed: You tin can buy into ID Coin applied science through any regular brokerage account. You don’t need to go anywhere about a confusing crypto commutation.

“Best of all… you don’t need to bound through any hoops to invest, like you do with Bitcoin.

“In a moment, I’ll bear witness you how to get in… and why it’southward so much easier (and safer) than typical cryptocurrencies.”

So what’south existence pitched hither? There are really no clues, other than that this is an disinterestedness investment — buying Google in 2004, non ownership “the Net” — and nosotros do get some confirmation that Okta (OKTA) at least was their “ID Coin” idea dorsum in 2017 or 2018. But what else might they be recommending as a play on advancing blockchain technology and cryptocurrencies?

I suspect that they praobably are pitching Ethereum and probably some DeFi cryptocurrencies as speculations in some of their “special reports,” those things often leak through to lower-cost newsletters and Ethereum is the beginning logical step into cryptocurrencies equally tokens that enable new technology and do things, that aren’t primarily envisioned every bit just a “store of value” like Bitcoin is.

Merely really, absent enough clues from the Thinkolator, my approximate (and this is a guess) is that they are either pitching Okta and a couple other companies that could be involved in blockchain projects for the authorities, with Accenture probably the most logical single idea at that place… or, more likely, that they are standing on with the big moving picture pitch and recommending not a stock, but a fintech ETF that touches on a lot of these blockchain and next-generation finance ideas.

The about likely targets in that instance, are ARK Fintech Innovation Fund (ARKF) and the somewhat bottom-known Siren Nasdaq NexGen Economy Fund (BLCN). Those are both actively-managed ETFs, meaning they choose stocks based on the inquiry and strategy of the manager, not based on an index or an automatic quantitative screening methodology (BLCN follows an alphabetize, but they fabricated up the index), so they are inherently more volatile and higher risk, and Cathie Wood at ARK is, even after a rough month, probably the most ardently followed growth investor out at that place at the moment…

… but if we’re talking specifically about leverage to cryptocurrencies and stocks that have some heavier “blockchain” exposure, I’d say that Siren probably has the edge at the moment and is a slightly more likely pick. BLCN is more specifically designed to bet on blockchain, while Cathie Wood’s ARKF is more generally focused on “Financial innovation.”

This is how the Siren fund is described:

“The investment seeks long-term growth by tracking the investment returns, earlier fees and expenses, of the Siren Nasdaq Blockchain Economic system Index. Under normal circumstances, at least eighty% of the fund’s assets, will be invested in component securities of the index. The alphabetize is designed to measure the returns of companies that are committing material resource to developing, researching, supporting, innovating or utilizing blockchain technology for their proprietary use or for use by others”

And BLCN has the reward of being a little flake less volatile and a little less well-known, so it feels “special” to get that idea from a newsletter — you might exist a picayune grouchy if you paid for a tip and they said “go purchase 1 of the ETFs that anybody is already talking near.”

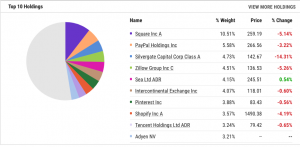

Here are the top weightings of those two ETFs, by the way — this is ARKF:

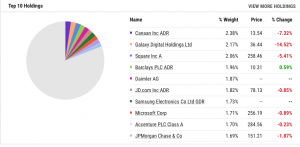

And this is BLCN:

Both accept done very well, though ARKF is much more concentrated (the top holding, Foursquare, is 10% of the fund — BLCN’s largest weighting is well-nigh two%), and has clobbered BLCN over the past couple years:

Just you tin can also come across that they missed out on some of the wild volatility of the ARK funds this yr, then twelvemonth-to-date BLCN has been

maybe a little

less stress-inducing:

And then there you have it… “ID Coin” is the thought that blockchain will help to build new identity systems, and therefore y’all tin can invest in either some companies that provide identity security services, as they recommended Okta in the by or, possibly, companies that might contract with the government for future advances in digital identity security like Accenture… just really, information technology’s nigh likely that for this metaphorical “ID Coin” investment what they generally mean is “invest in the idea of blockchain becoming a big deal”… and for a passive and semi-diversified bet on that theme, my guess is that they’re recommend the Siren Nasdaq NexGen Economic system ETF (BLCN), which is new and largely unproven, but is invested in a variety of companies that are either directly bitcoin/blockchain players, like Canaan and Galaxy, or big diversified companies (yes, like Accenture… simply besides JP Morgan, Microsoft and others) that are somewhat more quietly looking to build and profit from blockchain projects.

In that location are other ETFs in this infinite, too, of course — some other candidate that’south more aggressively cryptocurrency focused is Amplify Transformational Data Sharing ETF (BLOK), which focuses a flake more than on the direct Bitcoin/token plays like Microstrategy (MSTR), Marathon Digital (MARA) and HIVE Blockchain (HIVE.V). That’south by and large more levered to Bitcoin prices and more volatile than BLCN.

You could do worse than these ETF investments, particularly if you just want to position your portfolio in such a way every bit to benefit a picayune more directly from a variety of potential blockchain projects that might make a large difference in the existent economy over fourth dimension. These aren’t likely to provide super-sexy returns, zippo at all like going back in time and ownership Bitcoin for a nickel, simply sometimes it’s all-time to focus on the broad theme and leave the wildly speculative ideas and company-specific risks for the adjacent guy.

The soothing chart? That’s BLCN compared to Bitcoin — if you bought the ETF you clearly benefitted from the surge in Bitcoin over the past few months… but when Bitcoin crashed in 2018, dropping by 75% or more, BLCN was mostly pretty flat and, at its worst moment, was down about 20%.

Not the kind of strategy everybody would love, of class, but a lot less volatile than dabbling in cryptocurrencies themselves, or fifty-fifty focusing on a few of the more direct crypto plays in the stock market — and volatility, if we retrieve, is only fun on the way

upwardly.

Sorry we don’t have a lot of definitive comments for you on this “ID Money” stuff, dear friends, but that’s what I can parse out of the ad for you… and I idea I’d better jump in and at least share what thoughts I accept, imprecise though they are, given the wild numbers of questions popping up.

If you’ve got other ideas in this infinite you’d like to chat or ask near, feel gratuitous to use our happy little comment box beneath… and, as always, cheers for reading!

Disclosure: Of the companies mentioned higher up, I own shares of Okta, Amazon, Galaxy Digital, and Google parent Alphabet. I volition non trade in any covered stock for at least iii days, per Stock Gumshoe’s trading rules.

Irregulars Quick Take

Paid members get a quick summary of the stocks teased and our thoughts here. Join as a Stock Gumshoe Irregular today (already a member? Log in)

Source: https://www.stockgumshoe.com/reviews/stansberry-innovations-report/ok-ok-lets-talk-about-that-id-coin-teaser-pitch/

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media