Decentralized exchanges (DEXs) allow users to merchandise straight between themselves without the demand for a central intermediary. They come with a lot of benefits and several such platforms exist, each with their own governance token.

As one of the market place’s most popular DEXs, SushiSwap has a lot going for it. Only for beginners, it can be tough wrapping your head around how to apply it. Here, we detail how DEXs piece of work and

how to use SushiSwap, with a pace-past-step guide on the latter.

In this guide:

- How traditional crypto exchanges work

- Decentralized Exchanges (DEXs)

- What is SushiSwap?

- The SushiSwap AMM

- Liquidity pools

- SUSHI token

- How do cryptocurrency swaps work?

- How to connect your crypto wallet to SushiSwap

- Stride ane. Go to Sushi app

- Step 2. Connect your wallet to SushiSwap

- Step iii Select your wallet from the list of supported wallets

- How to Swap crypto on SushiSwap

- Step 1. Select blockchain network for your token exchange

- Step ii. Select token to swap

- Pace 3. Import tokens in your crypto wallet

- How to add liquidity to SushiSwap

- Footstep 1. Determine what token y’all want to eolith

- Step two. Add liquidity on SushiSwap

- Step iii. Check your provided liquidity and withdraw it

- SushiSwap vs. Uniswap

- Should y’all use SushiSwap?

- Frequently asked questions

How traditional crypto exchanges work

A cryptocurrency substitution is

a platform that allows people to merchandise cryptocurrencies for additional assets, such fiat or digital currencies. Different crypto exchanges might offer different features and options.

New users must register

before they tin can trade on a centralized cryptocurrency substitution. There are unlike levels of verification. In some cases, just confirming your email address is plenty. Others crave you lot to upload a passport photo. This KYC (Know Your Client) process is necessary to ensure that crypto-related businesses comply with anti-money laundering measures.

Although cryptocurrency exchanges can be compared to stock exchanges in many ways,

the main difference is the way that traders make profits. Stock exchange traders trade assets to brand money from changes in rates. Cryptocurrency exchange traders sell and purchase avails, but

they can also turn a profit from volatile currency rates. Although stock exchanges may have fixed hours of operation,

crypto exchanges are open 24 hours a day, vii days a week, and 365 days a calendar yr.

To outset cryptocurrency trading on an substitution,

you will first demand to fund your wallet. This means you will need to add fiat currency such as USD or EUR to your account through a bank transfer or using your credit or debit card. The exchange acts as a custodian. It problems IOUs to users for them to trade on the platform.

To trade crypto on an exchange, users tin can fix orders. Equally with the stock exchange, the

centralized or traditional cryptocurrency exchange platforms offering market orders, limit orders, and stop-limit orders.

Decentralized Exchanges (DEXs)

DEXs are decentralized applications (DApps) that permit users to merchandise directly between themselves

without the need for a central intermediary such equally Binance or Coinbase. They can provide admission to more cryptocurrency tokens and financial services that you won’t find on centralized exchanges. Some unique options offered by DEXs include flash lending, yield farming, and token staking.

This infrastructure of a DEX is entirely different from centralized exchanges, where users hand over crypto avails to the commutation.

Initial conceptions of DEXs were to

eliminate the demand to take any primal authority

to approve or supervise trades within an substitution. DEXs tin can use smart contracts to operate automatic order books or automated market place makers and trades. They are truly peer-to-peer and follow the principle of a decentralized network, which stands at the core of cryptocurrency and blockchain technology.

Some early DEXs used the social club book arrangement, which ways that a network node was keeping track of the orders. And so automated market place maker (AMM) DEXs were introduced, which are now the virtually pop blazon of decentralized exchange. They use smart contracts to create liquidity pools which are then used to exchange the tokens. Some of the nigh pop AMM DEXs are SushiSwap, Uniswap, PancakeSwap, and more are launched every year.

What is SushiSwap?

SushiSwap is a decentralized exchange that uses the AMM protocol,

and it is based on the Ethereum blockchain. Created in the summer of 2020,

it is a forked version of Uniswap. While some core features are the same, it also offered new financial services. For instance, it does non have an club book, instead of using smart contracts to facilitate the selling and buying of crypto. An algorithm determines the price.

Initial plans for the projection were made past

an private who went by the pseudonym Chef Nomi. Soon, some other pseudonymous core correspondent,

0xMaki, was added to the team.

The initial liquidity of the platform was obtained from Uniswap

by using a novel, creative, and ethically questionable method called a vamp attack. This strategy is used to bootstrap automated market place makers and source liquidity.

The initial liquidity is non fatigued organically only is instead sourced from some other platform.

SushiSwap strongly incentivized liquidity suppliers on Uniswap to drift by using additional rewards in SUSHI tokens (which represents supplied liquidity).

While SushiSwap used the lawmaking of Uniswap as its foundation, it introduced some key differences. Most notably, rewards in SUSHI tokens are distributed.

SushiSwap’s native token, SUSHI (which is too a governance token), is awarded to liquidity providers. SUSHI holders, unlike Uniswap’s (UNI), can even so earn rewards later they stop providing liquidity.

Later $1 billion in liquidity pool tokens were staked on the platform, the SushiSwap squad initiated the vampire attack.

On September 9, 2020, $840 million of liquidity was migrated from Uniswap.

Some controversy related to SushiSwap

10% of the SUSHI tokens were intended for the development fund, which was in complete command of Chef Nomi. One interesting fact to mention is that

Chef Nomi, the sole beneficiary of the project’s admin keys, decided to sell all their SUSHI, worth approximately $14 million. This crashed the token’s price past nigh half.

After an initial try to justify his actions, the community lost trust in Chef Nomi’s abilities and was forced past the community to leave the project. Chef Nomi transferred control to Sam Bankman Fried, the CEO of cryptocurrency exchange FTX and quant fund Alameda Research. Thereafter, Sam transferred the admin cardinal’s control from the substitution to a multi-signature wallet that was managed by ix people chosen by the community.

A few days after,

Chef Nomi came back to apologize to the customs

and purchase back the amount of SUSHI tokens that he had sold and and so put them all back into the devfund.

The SushiSwap AMM

So,

how to utilise SushiSwap? Let’due south beginning understand how this application works.

SushiSwap is congenital on an AMM, which uses smart contracts to execute transactions.

This model uses liquidity pools, which allow users to eolith tokens and go liquidity providers (LPs). Other SushiSwap can apply the funds in the liquidity pools to swap their tokens. These

LP users receive a small percent from the fees generated by trades, which is how you can earn a passive income through yield farming.

Other features of the SushiSwap Dex include SUSHI token staking, lending, and purchasing newly launched tokens through the MISO service.

SushiSwap offers multichain back up

and includes the most pop networks, such as Ethereum, Polygon, BSC, but also newer chains like Harmony and Fantom.

Each swap needs to pay a 0.30% transaction fee. This fee is distributed among liquidity providers (0.25%) as a advantage for contributing to the liquidity puddle, and 0.05% goes to SUSHI token holders who staked in SushiBar (farm xSUSHI).

Notation that on all DEX, traders need to set a slippage fee, which is set up in percentage and is needed to embrace a potential cost departure between the time of your trade and the actual fourth dimension the trade gets executed.

Liquidity pools

Liquidity pools are a core element of any AMM-based DEX. In order to enable cryptocurrency trading, the application needs to accept those tokens available in a liquidity pool. Anyone can become a liquidity provider and earn rewards (0.25% of the transaction fee). This fee is proportional to how much liquidity they add to the pool. This is a great way to get extra yields from tokens sitting in your wallet.

Each liquidity provider receives LP tokens to correspond the share of the liquidity pool. In some cases, these LP tokens can be farther deposited in Farms, and this procedure is called yield farming.

Note that liquidity providers are exposed to the take chances of impermanent loss.

SUSHI token

In the start, SushiSwap implemented a decentralized arrangement for community governance, instead of the system used past Uniswap.

The community governs the protocol. Major structural changes are made through forum discussions, official proposals, and community voting.

A SushiSwap programmer called 0xMaki, along with a core team supporting developers, make smaller operational decisions. The customs besides voted on the platform’s construction and cadre team.

SushiSwap’s native

SUSHI token is the foundation of its community governance. Information technology allows holders to vote on platform proposals.

SUSHI is an ERC-20 token

created on the Ethereum network and has a maximum supply limit of 250 meg. All 250 million tokens volition be minted by Nov. 2023.

You can stake SUSHI in SushiBar

to earn a proportion of the platform’due south profits. These earnings are distributed as xSUSHI tokens. This is essentially SUSHI tokens purchased on the open marketplace with the profits from the substitution.

This open market operation generates passive revenue for SUSHI stakers and also provides constant buy pressure for tokens.

SushiSwap trades approximately $0.5 billion daily. This means that the profits from the 0.05% fees across all pools corporeality to effectually $250,000 per day.

Even so,

ii/3rds of SUSHI tokens earned get into a lockup address

and are afterward distributed to the LPs who earned it from the subcontract. Every bit of Mar. 2022, a SUSHI token trades at around $2.ix, and the marketplace capitalization stands at $388 million, as there are simply about 51% tokens in circulation (~ 127 one thousand thousand SUSHI), co-ordinate to CoinMarketCap. Yous

tin buy SUSHI tokens using many popular exchanges, including Binance, Kraken, Coinbase, FTX, etc.

How practise cryptocurrency swaps work?

Cryptocurrency swaps are very effective if y’all want to exchange one crypto for another without going through the fourth dimension-consuming and costly process of first converting your crypto to fiat. Furthermore, by swapping cryptocurrencies directly, investors are able to admission tokens with a low marketplace cap, which may be unavailable on larger exchanges.

For instance, if you’d wish to exchange SAND for SUSHI, y’all would need to execute a few trades earlier completing this merchandise, as there might be no exchange that offers this specific trading pair. Investors would need to advisedly program their trades and probably utilize an intermediary token such as USDT to successfully execute their desired trade. Notwithstanding, this merchandise would also require the trader to pay multiple transaction fees (at least twice if your merchandise is SAND > USDT > SUSHI), and the value of the outcome tokens could exist less due to the sudden volatility of the assets.

These bug are resolved by instant swap tokens functionality offered by AMM exchanges, such as SushiSwap. This allows users to exchange one crypto asset for another. Only enter the amount that yous wish to exchange, along with the desired trading pair, and the token swap service will instantly convert your coin. This method of transacting requires yous to only pay one transaction fee.

Token swapping offers a secure and convenient crypto-to-crypto gateway. You tin exchange any corporeality, given there is plenty liquidity. Finally,

let’s encounter how to use SushiSwap.

How to connect your crypto wallet to SushiSwap

SushiSwap has a convenient interface, which makes it easy for anyone to use it, even new DeFi investors. Hither’due south a pace-past-step guide on how to apply SushiSwap and connect your crypto wallet to it.

Pace ane. Go to Sushi app

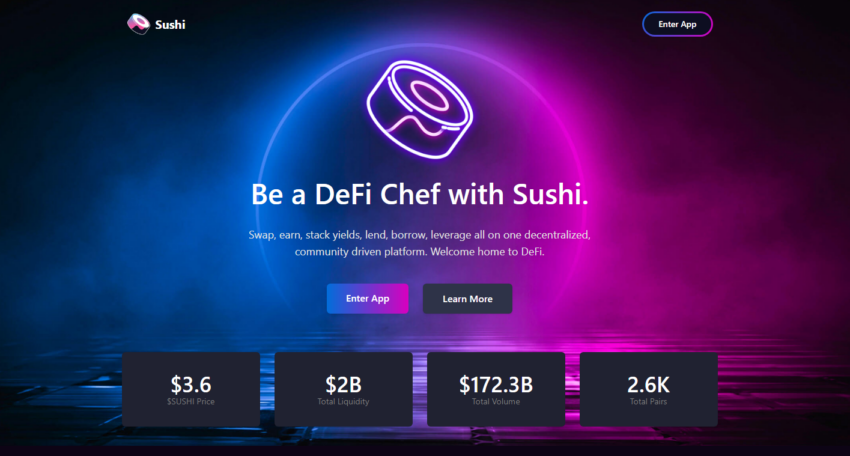

Assuming you already have a custodial cryptocurrency wallet, just visit the spider web interface of the SushiSwap DEX: https://world wide web.sushi.com.

Click on enter app, and yous volition be redirected to the SushiSwap page, where you tin connect your wallet.

Step 2. Connect your wallet to SushiSwap

Here is where yous can bandy tokens. This process requires you to connect your wallet before processing whatever transaction using the swap. You can find a push button on the elevation-right, but besides in the heart, under the bandy window, that urge you to connect your private wallet.

Step three Select your wallet from the list of supported wallets

After y’all click on the “Connect to a wallet” push, y’all must choose your wallet from this list of supported wallets. Notation that WalletConnect supports a bunch of wallets, including TrustWallet.

In this example, we will use MetaMask, since this is the virtually popular browser-based wallet and virtually Dapps support it.

Bold yous already take your MetaMask account installed on your browser, you will get this window, and your wallet volition ask you to permit it to connect to SushiSwap.

Notation that at that place will be 2 notifications from MetaMask, and you volition have to click Connect on both of them to successfully connect to SushiSwap DEX.

Afterwards, you lot will get to see your continued wallet on the DEX.

And that’s how you lot connect your wallet to SushiSwap. Note that yous should also disconnect your wallet from the DApp. You can do that from your wallet. If you’re using MetaMask, go to the three-dot menu nether your business relationship prototype and select connected accounts.

How to Swap crypto on SushiSwap

Swapping cryptocurrency on SushiSwap is very easy, and yous’ll get the hang of it in no time. Bold you’ve already connected your crypto wallet to SushiSwap and that y’all have at least one token to commutation and enough funds to comprehend the blockchain fees for the chosen network, you’re all set to go.

Here’s a step-past-pace teaching on how to use SushiSwap to aid you perform your first swap.

Footstep 1. Select blockchain network for your token substitution

On the top-right, next to your wallet’s address and balance, yous will find the symbol for the chosen blockchain network. Click on that icon to change the network.

As yous can run into, SushiSwap supports many blockchains, ranging from the popular ones like Ethereum and Polygon to other less pop ones such as Celo. Note that you can also switch the network from your MetaMask wallet.

In this example, we will cull Polygon for swapping tokens on SushiSwap. On the Polygon network, the gas fee is paid in MATIC, and a small corporeality of MATIC tokens will be needed to swap tokens. Notwithstanding, each blockchain network has a different native coin that is used to express its gas prices.

Step 2. Select token to bandy

On the Bandy folio, select the token you want to substitution and the desired token that you want to receive. Here you should as well enter the verbal corporeality yous want to exchange of the first token.

Subsequently you’ve selected the tokens and entered the desired corporeality, click on

Bandy.

A new window will inquire you lot to review your token bandy and

Ostend the Swap. After you lot click on the confirmation push button, your wallet will prompt you to review the gas prices and confirm the transaction from your wallet. Note that all blockchain interactions volition incur a transaction fee.

Afterward you confirm the transaction from your MetaMask wallet, the transaction will be submitted to the blockchain. Also, the SushiSwap interface will requite you the pick to import that token’s smart contract’s address to your wallet.

Later the transaction is confirmed, you volition as well meet this confirmation from the SushiSwap interface, stating the performed swap and a link to see the transaction on the cake explorer.

Afterward the transaction is completed and you lot import the token’s address to your wallet, you volition be able to run into information technology in your MetaMask wallet.

Stride iii. Import tokens in your crypto wallet

Note that the token that your wallet hasn’t used earlier may not be visible from the default interface and may require manual add-on. Notwithstanding, all tokens are visible from the blockchain transaction cake viewer.

Yous can select the choice to import your token later on the transaction is submitted (at that place will be a popup from the SushiSwap interface), or you tin can do it afterward from the

Import tokens

push button from your MetaMask wallet.

That’s it! Congrats on successfully swapping crypto on SushiSwap.

How to add liquidity to SushiSwap

Nosotros’ve already established that liquidity pools are the core of AMM-based DEX, such as SushiSwap.

Liquidity providers earn a 0.25% fee on all trades

proportional to their share of the pool. Fees are added to the pool, accrue in real-time, and can exist claimed when yous are withdrawing the provided liquidity.

Anyone tin can go a liquidity provider and earn passive income from their crypto holdings. Hither’s a stride-by-step guide on how to provide liquidity on SushiSwap.

Footstep 1. Decide what token yous want to deposit

The get-go thing to do is to decide what tokens y’all desire to provide as liquidity. It might exist tokens that yous already hold in your wallet and want to use them to generate an extra advantage. Note that when providing liquidity for a DEX, you will demand to provide the same value of 2 different tokens.

Another aspect to take into consideration are the incentivized pools nether the subcontract choice of the DEX. Well-nigh DEXs, including SushiSwap, have a listing of incentivized pools where users tin can deposit the LP tokens generated from depositing liquidity. This process is usually chosen yield farming.

But look, there’s even more to consider. The tokens offered by the DEX don’t necessarily mean they’re part of a respectable project, as about would believe well-nigh the tokens they encounter on exchanges. The truth is that anyone tin list their newly created token on a DEX. And and so you lot also have the risk of impermanent loss, which is impossible to overcome, only providing liquidity to pools that take a high APR volition still be worth the effort.

Later on considering all of these aspects and deciding what is the token pair to deposit in the liquidity pool, make certain you have that pair in equal values in your wallet. You can also utilise the Swap role on SushiSwap to get the tokens you need for depositing liquidity.

Pace 2. Add liquidity on SushiSwap

Caput over to

Pool > Add together

from the top bill of fare and select the token pair you lot want to deposit as liquidity. You’ll too need to input the amount for each token, but they will need to exist of equal value.

After all these details are selected, click on

Approve Token, to give SushiSwap permission to access your tokens. Delight read the notification carefully and so hit

Confirm.

After the tokens are approved (this process will be needed for both tokens, if this is the showtime time providing liquidity for them), go back to the SushiSwap interface and

Confirm Adding Liquidity.

You volition get a popup with the information about your liquidity deposit, stating the corporeality of each token deposited, likewise every bit your share of the liquidity pool. Click on

Confirm Supply.

So you will have to also confirm the transaction from your wallet, as depositing liquidity to a DEX will also incur transaction fees. Y’all have to click

Confirm

once again.

After you get back to the SushiSwap interface, you volition meet a observe with the provided liquidity.

Your funds are now deposited in the liquidity puddle and are no longer bachelor in your wallet. If you want to use your funds, you lot will take to go to your liquidity in SushiSwap and withdraw it.

Pace 3. Bank check your provided liquidity and withdraw information technology

To see your liquidity pools, go to

Puddle > Browse.

If y’all want to check the rewards that your eolith has generated from trading fees, add together more than liquidity to the same pool, or simply want to withdraw your liquidity, this is where you can manage your pools.

Congrats on making it this far in this guide on how to utilize SushiSwap. You at present know how to apply the basic features of this popular DEX.

SushiSwap vs. Uniswap

Most decentralized applications are open-source, enabling developers to apace launch a new DApp using the lawmaking of an existing application, with just a few minor changes. This naturally leads to competition among like products. However, we could wait that this volition ultimately issue in the best products for end-users.

Undoubtedly,

the Uniswap squad is responsible for pregnant breakthroughs in the DeFi space. We could meet a futurity in which both Uniswap, SushiSwap, and other forks flourish. Uniswap may still be at the forefront of AMM innovation, merely SushiSwap could offer a more targeted alternative that focuses on the features the community wants.

Fragmenting liquidity between protocols that are similar is not ideal. AMMs are all-time when there is as much liquidity as possible in the pools. Splitting large amounts of liquidity in DeFi between multiple AMM protocols could result in a less pleasant experience for cease-users.

But when we’re comparing SushiSwap to Uniswap,

the fundamental difference lies in the DEXs tokens.

The founder of SushiSwap forked Uniswap to innovate the SUSHI token.

This was an boosted reward for farmers and liquidity providers.

While everything is the aforementioned on SushiSwap and Uniswap alike, in that location are some key differences:

- SushiSwap has a transaction fee of 0.30%, which is split betwixt the liquidity providers (0.25%) and SUSHI token holders (0.05%).

- Uniswap has ended its UNI token farming phase, but SUSHI yield farming is nonetheless live and well, with rewards in some pools reaching as high as 100% April.

- SushiSwap offers a different UI feel. It is designed equally a menu for a Japanese restaurant. It offers

Omakase

and

Onsen. This replaces Uniswap’s very simplified app.

Should yous use SushiSwap?

At present that you lot know how to use SushiSwap, you’re probably wondering if this is the all-time pick for you. DEXs are constantly evolving and are adding new features to their apps.

While Uniswap remains one of the dominant decentralized exchanges on the Ethereum network, SushiSwap is trying to expand to many blockchains. The DEX’s controversial launch and subsequent token launch have received a fair corporeality of publicity. Merely under all that controversy, SushiSwap has likewise added many new features and additional DeFi services such every bit lending and yield farming, and you tin can fifty-fifty stake SUSHI, the platform’s native token. The interface and visual design of the app accept been greatly improved, and the app is going through a rebranding now, to just Sushi.

Frequently asked questions

Users can access the SushiSwap DEX by connecting their crypto wallet to the web interface of the

DApp

. After you lot connect your wallet, you lot tin can start swapping tokens, become a liquidity provider (LP), or lend and infringe crypto.

You tin can use SushiSwap to swap cryptocurrency past merely going to the Bandy tab and selecting the ii tokens that you want to swap. Select the desired corporeality and so ostend the transaction from your wallet.

SushiSwap can exist used for ownership and selling cryptocurrency, providing liquidity, yield farming, and lending and borrowing tokens.

SushiSwap is a fork from the Uniswap DEX. Simply unlike its original lawmaking, the SushiSwap DEX offers more than features that permit users to better work with the DeFi space.

SushiSwap was created past 2 anonymous developers, known as Chef Nomi and 0xMaki.

Disclaimer

All the information independent on our website is published in good religion and for general data purposes only. Any action the reader takes upon the data institute on our website is strictly at their own risk. At Larn, our priority is to provide loftier quality information. We take our time to identify, enquiry and create educative content that is useful to our readers. To maintain this standard and to go along creating awesome content, our partners might advantage united states with a commission for placements in our articles. However, these commissions don’t bear on our processes for creating unbiased, honest and helpful content.

Source: https://beincrypto.com/learn/how-to-use-sushiswap/

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media