MATIC is the native token for Polygon, an Ethereum scaling solution that improves the speed and efficiency of the Ethereum network and reduces ETH gas fees through Layer 2 sidechains.

Polygon offers the Plasma Chains scaling model and the Ethereum Matic PoS Chain sidechain based on Proof-of-Stake (PoS) as a popular scaling option for various applications. Every bit an ERC-20 token, working on Proof-of-Stake, MATIC, enables crypto investors to do good from staking while using MATIC.

Staking involves locking upwardly your crypto assets in your personal cryptocurrency wallet for a specific period to contribute to the performance and safety of the blockchain network and earn rewards in the grade of boosted coins or tokens.

This article will explicate everything you demand to know about Polygon Matic staking and provide a detailed guide on where, why, and how to pale Matic tokens to earn staking rewards.

Permit’s get right to it.

What Is MATIC

MATIC is the native token and main transactional currency of the Polygon Network. It serves as a staking token for Polygon’s Proof-of-Pale (PoS) blockchain, making Polygon a unique Layer 2 solution. MATIC tokens are used equally collateral in the staking process, enabling users to participate in Polygon’southward consensus mechanism to validate transactions in return for staking rewards.

Polygon was rebranded from Matic Network in Feb 2021. The Polygon Network is a Layer ii scaling solution designed to increment transaction throughput and lower transaction fees for Ethereum users and developers.

Polygon was launched when Ethereum became congested with transactions equally its demand in the emerging decentralized finance (and NFTs) skyrocketed. Every bit a event, ETH fees increased, and the Ethereum network became too expensive for average users and developers running their decentralized apps (DApps) atop its ledger. The Polygon Network was designed to raise Ethereum’due south transaction processing speed, reduce gas fees, and enable the launching of sovereign blockchains and decentralized applications and the building of interconnected blockchain networks.

Additionally, Polygon is the just scalability solution to fully support the

Ethereum Virtual Automobile (EVM), i.e., it supports Solidity equally a smart-contract language, which means that DApps built on the Polygon Network will benefit from Ethereum’s Network effect without sacrificing its robust security.

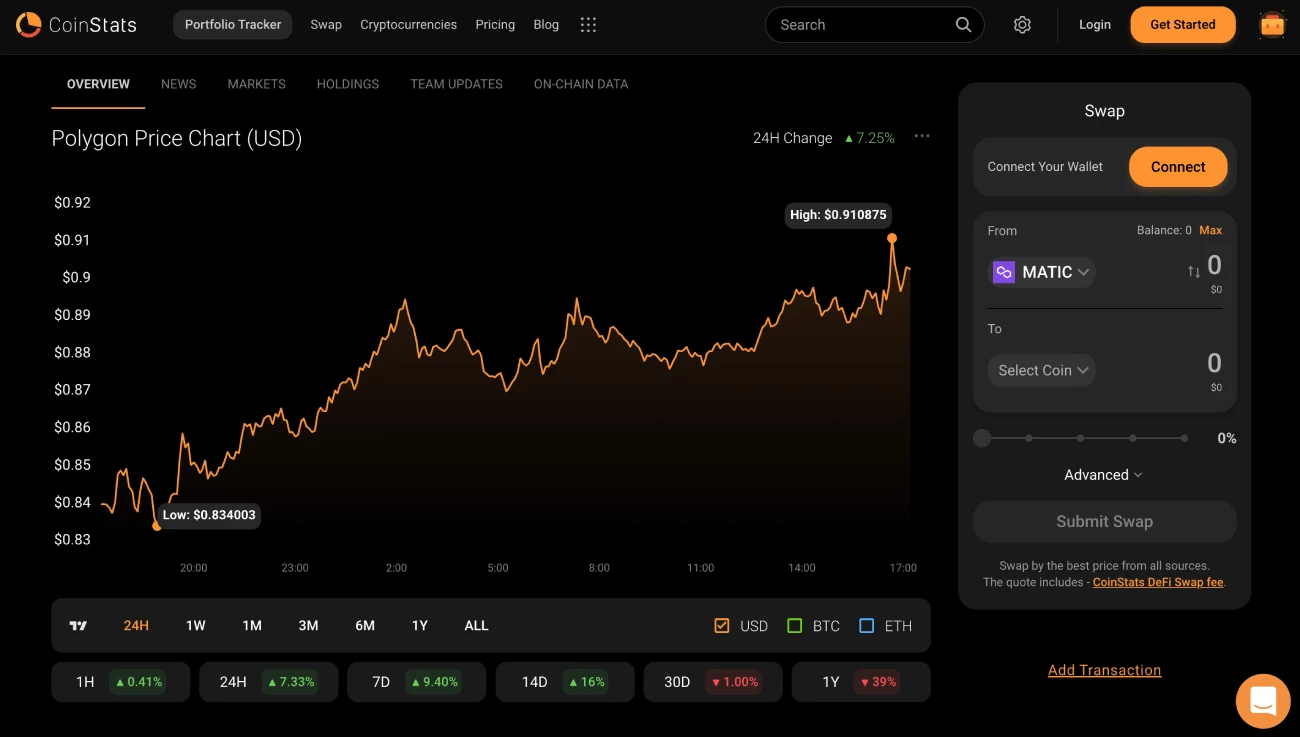

The value of Polygon’southward scaling technologies is as well reflected in MATIC’s price activeness. Check out the Polygon MATIC price, live market cap, 24h-trading book, full supply, circulating supply, and other metrics on CoinStats.

Become the latest crypto news and latest trading insights with the CoinStats web log.

Why Choose Polygon

Polygon has gained popularity in the crypto infinite in a short menstruation due to several reasons highlighted below:

Loftier DApp Usage

Polygon’south aim to provide a solution to the increased transaction fees and irksome transaction times on the Ethereum network has made it an bonny chain for decentralized finance applications (DApps). Polygon’s Ethereum Virtual Machine- (EVM)-uniform Proof-of-Stake (PoS) blockchain hosts prominent DApps, such as nonfungible token (NFT) marketplace OpenSea, Metaverse platforms Decentraland and The Sandbox, DeFi lending platform Aave, etc.

Loftier Scalability

Polygon has recently launched the Polygon zkEVM, the kickoff Ethereum-equivalent scaling solution that works seamlessly with all existing smart contracts, developer tools, and wallets. zkEVM is the first Ethereum-uniform scaling solution that leverages optimistic roll-ups following Zero-Cognition cryptography. The one-of-a-kind scaling solution is designed to cut down ETH fees and fifty-fifty outpace Visa’due south transaction throughput.

Loftier Security

Polygon Matic provides 3 types of security models for a developer to build their DApp upon:

- Proof of Stake security

- Plasma security

- Hybrid (Plasma + PoS).

How Does Staking Work

Staking only applies to blockchains built on the Proof-of-Stake (PoS) consensus machinery. PoS involves allocating responsibility in maintaining the public ledger to a participant node in proportion to the number of virtual currency tokens it holds. Participants staking their crypto in a PoS blockchain for an agreed-upon ‘staking period’ to provide value to the network and earn rewards in return are called validators. PoS validators are selected based on the higher number of staked coins. Anyone holding a required number of coins can participate in validation, i.eastward., verify transactions and earn staking rewards.

Proof-of-Work (Prisoner of war) is a common consensus algorithm that requires miners to compete to solve circuitous mathematical problems to verify and process transactions and add them as a new cake in the blockchain. The PoW mechanism of verifying transactions on the blockchain is robust and secure just also requires high energy consumption and a longer processing time. This hinders the number of transactions that tin be processed by a blockchain simultaneously and therefore causes a scalability result.

A Proof-of-Stake blockchain is less ability-consuming and, therefore, solves scalability issues faced by a Proof-of-Work (Prisoner of war) blockchain.

What Is Polygon Staking

Polygon is a PoS network, enabling crypto investors to stake Polygon (MATIC) to contribute to network security and decentralization and earn an attractive yield for their staked tokens. Staking Polygon may provide you with a meaning return on investment. According to Polygon, the typical APY for staking Polygon is viii%, and more than than ii.39 billion MATIC tokens are currently staked in various staking providers.

Polygon relies on a ready of validators, who stake their MATIC tokens as collateral to secure the network and earn rewards in exchange for their service. Validators run a full node, produce new blocks, participate in consensus, validate transactions, and earn rewards for performing network operations. To go a validator, ane needs to pale MATIC tokens with staking direction contracts on the Ethereum mainnet.

A validator node receives inflation-funded cake rewards and network-based transaction fees in return for proficient validator performance. Rewards are distributed to all stakers proportional to their stake at every checkpoint. However, slashing staked funds are placed at risk and tin exist penalized or slashed if a validator node commits a malicious human action like double signing or validator downtime.

Token holders, chosen delegators, who cannot or don’t want to run a validator node themselves, can participate indirectly by delegating their tokens to a validator. They secure the network by choosing validators and delegating their stake to validator nodes. Validators accuse a fee for running a service for delegators. While delegators share rewards with their validators, they besides share the risks.

Where to Stake MATIC

Some centralized exchanges to pale MATIC are Coinbase, Kraken, KuCoin, Bitfinex, Binance, FTX, Gemini, and Huobi. Yous tin can cull any of these platforms to stake your MATIC tokens. While yous can besides stake Polygon on decentralized exchanges, currently, your MATIC staked on a centralized commutation will give you college rewards.

The staking platform you choose must have a rails tape of good service and reputation, exist audited by blockchain security auditors such every bit Certik, and offer high returns on your staked MATIC tokens. You lot tin can utilize this stakingcrypto.io website to observe platforms providing the best staking rewards for your MATIC.

The staking process on most exchanges is very like. You must take MATIC tokens and some ETH to pay the Ethereum gas fees in an Ethereum-compatible wallet and create an account on your called platform.

How to Stake MATIC on Polygon

To pale MATIC, you must have MATIC tokens and some ETH to pay the Ethereum gas fees in an Ethereum-uniform wallet. Y’all’re welcome to visit the CoinStats step-by-footstep guide for buying

MATIC

tokens first if you don’t already take any.

Follow our MATIC staking tutorial on the Polygon website beneath.

Step #1: Visit Polygon Website

Enter the staking page on the Polygon website. You’ll be presented with an overview.

Step #2: Connect Your Wallet

On the page’s pinnacle right, click “Connect to a Wallet” and select the wallet (Metamask, Trust Wallet, etc.) containing the MATIC tokens yous wish to stake.

Footstep #iii: Select a Validator

Navigate to the staking folio, where y’all’ll come across links to the staking figurer, support, Polygon explorer, the network overview stats, etc. Check the chart containing important stats to select a adept validator. You must ensure ‘Checkpoints Signed’ are 100%, i.e., a validator hasn’t missed any checkpoints not to lose whatsoever tokens through slashing. The “Commission” column shows the percentage of rewards the validator takes from the full pale. You want the commission to be as low as possible to get more rewards.

Step #4: Get a Delegator

Delegate your tokens by clicking on the ‘Become a Delegator’ push. Subsequently you click “Corroborate” and “Ostend,” your tokens will be staked and earning rewards!

Liquid Staking MATIC

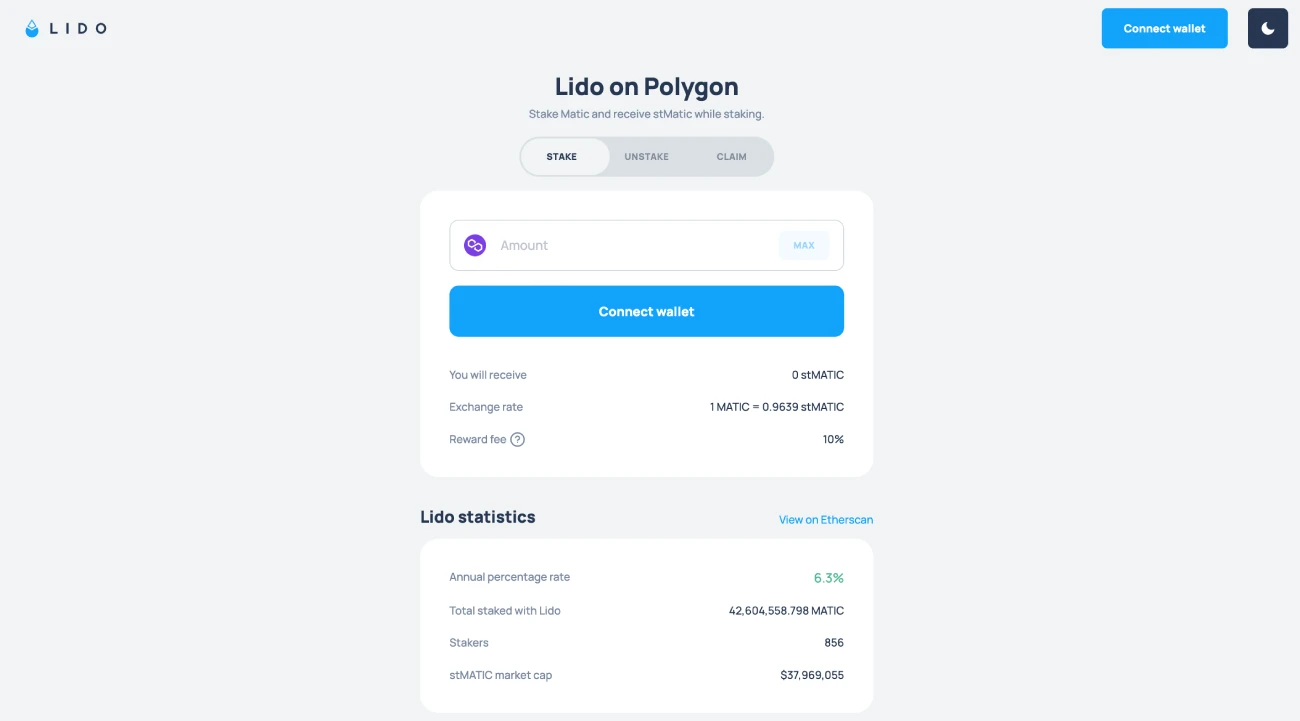

Lido Finance is a liquid staking protocol, allowing you to earn staking rewards without locking your MATIC tokens. When you lot stake your tokens, you receive the $stMATIC tradable liquid tokens in return. Again, you must have MATIC tokens and some ETH to pay the Ethereum gas fees in an Ethereum-compatible wallet.

Stride #1: Visit Lido Finance

Visit Lido Finance and click on “Stake MATIC”.

Stride #2: Connect Your Wallet

Click “Connect to a Wallet” and follow the instructions to connect the wallet (Metamask, Trust Wallet, etc.) containing the MATIC tokens yous wish to stake.

Step #iii: Bandy MATIC

Enter the number of tokens you lot wish to stake and click on “Unlock tokens.” Your MATIC tokens volition be swapped for $stMATIC tokens. You must confirm the transaction in your wallet.

Step #iv: Pale MATIC

Once yous’ve received the $stMATIC tokens, click “Stake now” and ostend the transaction in your wallet.

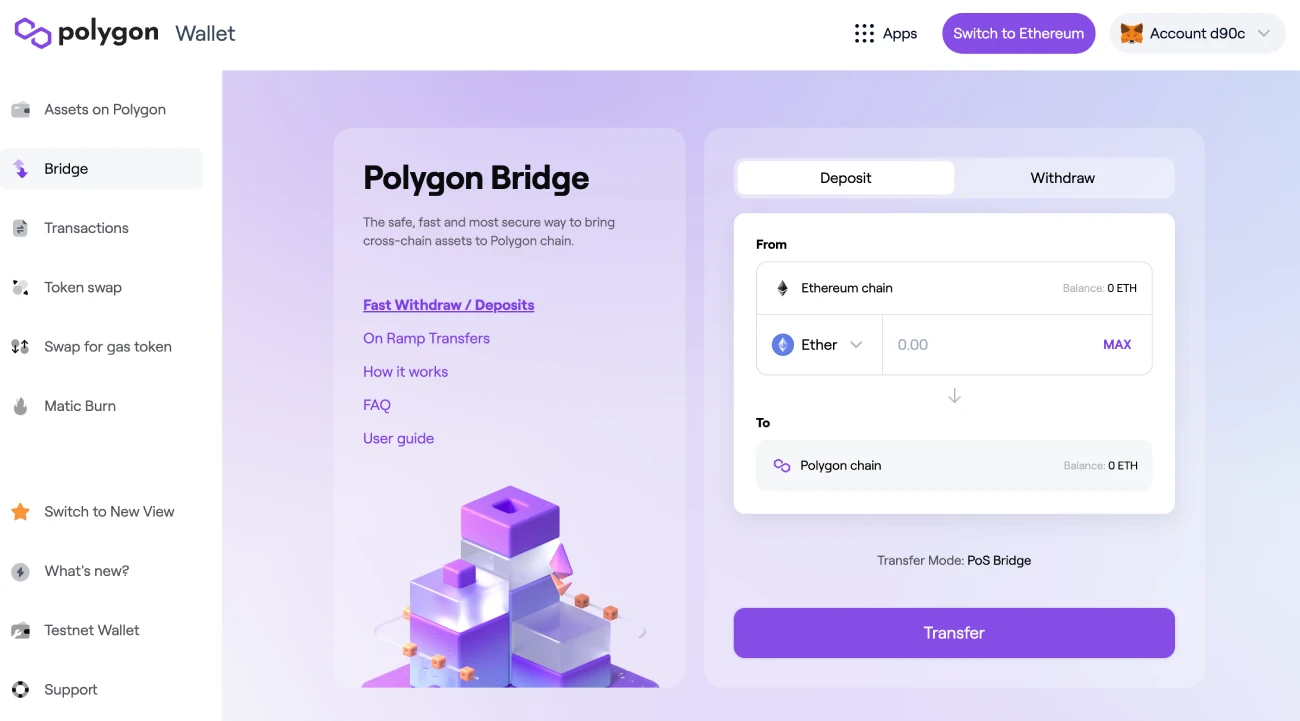

How to Use the Polygon Bridge

The Polygon Bridge ensures interoperability amongst blockchain networks by facilitating cantankerous-chain token transfers instantly without whatsoever third-party risks or restrictions on market liquidity. The Proof of Stake Bridge helps transfer tokens from Ethereum to Polygon and from Polygon to Ethereum.

Notation that information technology will accept about ii hours using PoS and 7 days using the Plasma Bridge for the transfer.

To transfer tokens from the Ethereum blockchain to Polygon Network, you must take a compatible crypto wallet like Metamask and follow the steps below:

- Click on Polygon Bridge and log into the Polygon Web Wallet.

- Connect your crypto wallet.

- Sign to confirm the connection of your wallet.

- Select the Bridge from the left menu bar.

- On the “Deposit” tab, click on the token proper noun you want to bridge, enter the number of the tokens, click “Transfer,” then “Continue.”

- Review all the transaction details and click on “Go along” once more.

- Ostend the transfer.

Beneath are the steps for transferring tokens to Ethereum from Polygon through the Proof of Stake Span:

- Click on Polygon Bridge, then “Withdrawal,” and enter the number of tokens you want to bridge to the Ethereum blockchain.

- Click “SWITCH BRIDGE” and select the PoS Bridge.

- Click “Transfer,” then “Continue” afterwards you’ve reviewed the estimated gas fees for the transaction.

- Check the transaction details, sign, and click “Ostend.”

After processing the transaction, you lot tin can encounter the tokens in your Metamask wallet.

Pro Tip: Ever send small examination transactions to new wallet addresses or when using a new platform to prevent losing all your tokens. #CoinStatsTips @coinstats

Click To Tweet

Last Thoughts

Polygon aims to create an Internet of Things (IoT) for the Ethereum blockchain. The project provides an like shooting fish in a barrel framework for new and existing blockchain projects to build on Ethereum without scalability problems and without sacrificing decentralization or security.

The staking of Polygon’southward token, MATIC, on the Polygon blockchain enables users to earn interest for helping validate transactions on the blockchain.

Staking MATIC tokens is an excellent mode to back up the Polygon network while earning rewards in return. While in that location are some risks associated with staking, such as the potential for hacks or loss of funds, these can be mitigated by taking proper precautions and storing your funds in a secure wallet. Overall, staking is a bang-up way to earn rewards on your investment and support the growth of the crypto ecosystem.

Source: https://coinstats.app/blog/how-to-stake-matic/

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media