Can I merits crypto losses on my taxes?

You lot can and should written report crypto losses on your taxes. In this guide, nosotros’ll bear witness you how to reap tax benefits through realizing crypto losses for the 2022 taxation year.

Tin can I write off crypto losses?

Claiming crypto losses on taxes is important for two chief reasons:

-

The IRS requires that you written report all sales of crypto, equally it considers cryptocurrencies property.

-

You can use crypto losses to offset capital losses (including hereafter capital losses if applicable) and/or to deduct up to $3,000 from your income.

In that location are 2 ways in which reporting crypto losses can lower your taxes: i is through income tax deductions, the other is through offsetting capital gains.

Income tax deduction

If you lot experience total capital losses beyond all avails, you may deduct up to $3,000 of your losses from your income. Yous may not deduct losses from your income if you experienced full capital gains across all assets, just you lot can still utilise these losses to offset capital gains in other avails.

Offsetting capital gains

Regardless of your assets’ collective performance, virtual currency losses tin be used to offset other capital letter gains, either from the current tax year or hereafter taxation years (if carried forward).

Carryforward example

-

In 2022, Jill had internet gains of $four,000 and internet losses of $30,000, for an overall capital loss of $26,000, which she reports on her income taxes.

-

In 2023, she has more than success in the market place, and has an overall gain of $15,000. She tin use $15,000 of her $26,000 of 2022 losses to completely offset her gains.

-

In 2024, Jill has $20,000 of overall gains. She uses the remaining $11,000 of her 2022 losses to offset some of her gains, reducing her capital gains total to $9,000.

Strategically selling assets at a loss in order to beginning your gains is called crypto tax-loss harvesting. For more on this strategy, visit our Guide to Crypto Tax-Loss Harvesting.

Delight exist aware that selling an asset and rebuying information technology within 30 days is considered a crypto wash sale. In the U.S., launder sales are not permitted for securities. Considering cryptocurrency is not considered a security, launder sales are technically permitted for crypto.

However, politicians and regulators have indicated that the rule may exist extended to crypto at some point. Nosotros recommend safer strategies to reduce your majuscule gains totals.

Tin I report NFT losses on my taxes?

Co-ordinate to the IRS, whatsoever crypto-to-crypto transaction is a taxable event. For this reason, all of the post-obit NFT activities are taxable capital gain/loss events for hobbyists:

-

Purchasing an NFT with cryptocurrency

-

Trading an NFT for another NFT

-

Selling or otherwise disposing of an NFT for a fungible cryptocurrency

For more than guidance on reporting NFT losses on your taxes, see TokenTax’south NFT Tax Guide

these six tips for NFT creators and investors.

Calculating crypto losses

To calculate your crypto capital loss, yous apply the same formula y’all would for calculating crypto gains: Gain – cost basis = capital loss. Proceeds are the total sum y’all received upon disposing of the asset, while cost basis is the total sum for which you acquired the asset, including whatever transaction or gas fees. The effect of your calculation will be negative if you’ve experienced a loss.

What are short- and long-term gains?

Short-term capital gains and losses come up from the auction of property that you held for i year or less. These gains are typically taxed as ordinary income at a rate between 10% and 37% in 2022.

Long-term capital gains and losses come from the auction of holding that you held for more than one year and are typically taxed at preferential long-term capital gains rates of 0%, 15%, or 20% for 2022.

Majuscule loss example

-

Yous buy 5,000 UST for $5,000 on Coinbase, and pay a 1% transaction fee ($50). This makes your cost footing $v,050.

-

Later the Terra Luna crash, you sell your v,000 UST for $100.

-

$100 – $five,050 = -$4,950

-

Yous report a $4,950 loss on your taxes

Afterward calculating and reporting individual transactions, you also demand to find your internet losses and gains so you tin can determine if you have overall losses or gains. If y’all have overall losses, you tin can deport frontwards losses to future tax years.

Forms to merits your crypto losses

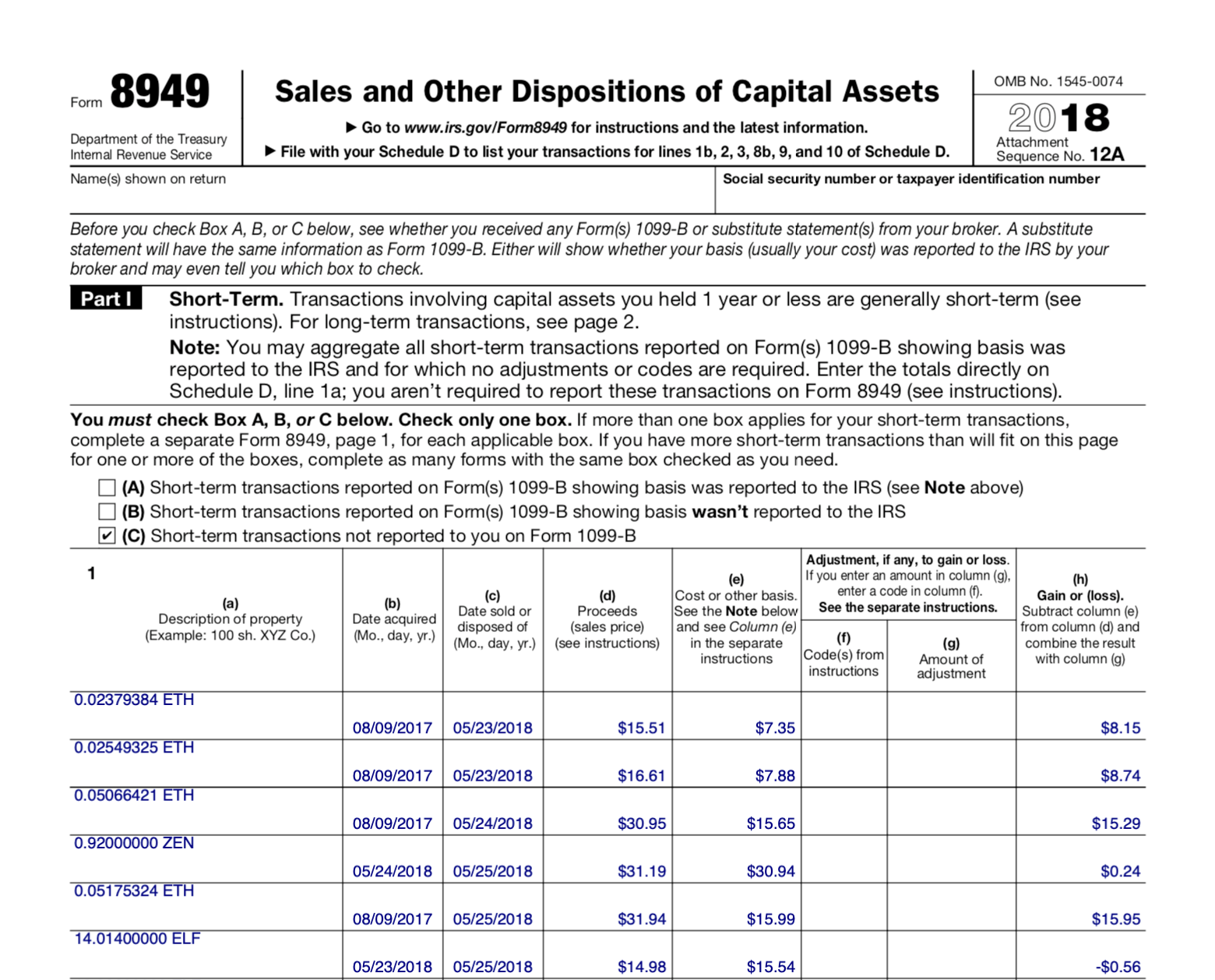

At that place are certain forms that y’all should utilize to report crypto losses on your taxes – you lot written report your crypto losses with the Form 8949 and 1040 Schedule D. Each sale of crypto during the tax year is reported on the 8949. If y’all had non-crypto investments, they need to be reported on separate Form 8949s when yous file your taxes.

The example below shows a completed crypto Form 8949, including a loss.

Please see our commodity “How to Study Crypto on Your Taxes: 5-Step Guide” for consummate instructions on how to make full out Form 8949.

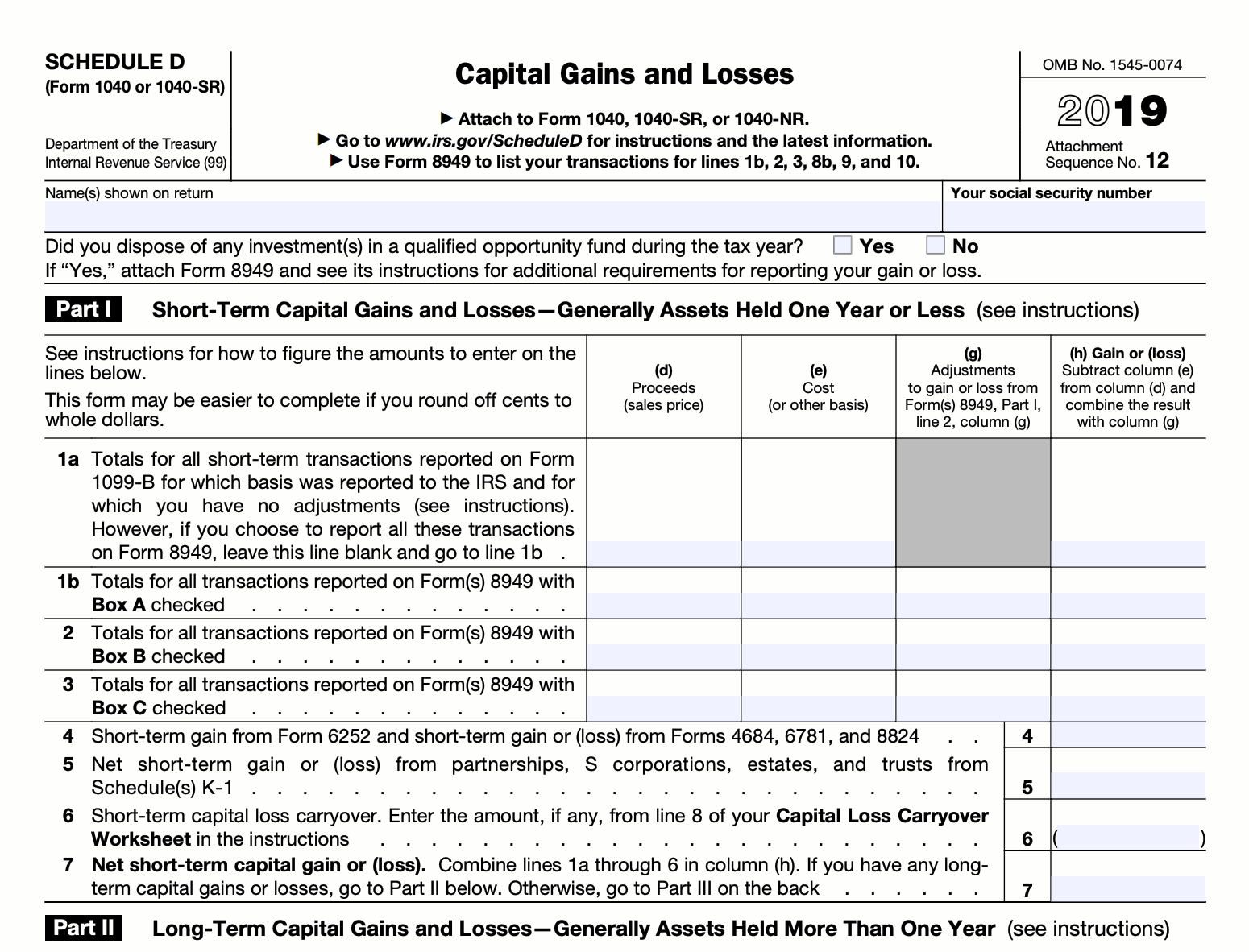

Your overall long-term and short-term gains and losses totals are reported on Form 1040 Schedule D. This is where yous can also include losses carried forward from past years.

Can y’all deduct stolen crypto on taxes?

If you’ve been hacked or rug-pulled, y’all’re probably wondering if you can go revenue enhancement deductions for crypto scams.

Unfortunately, if you no longer retain ownership of the crypto, there is no clear method for challenge theft losses. In 2018 the IRS clarified that the just losses immune to be written off with Grade 4686 (Casualties and Thefts) were those avails lost as a event of a federally declared disaster.

Even though yous can’t become a deduction for stolen crypto, it’due south important that you record the theft in your TokenTax crypto tax software and so it doesn’t erroneously friction match up those tax lots with sales.

What happens if I don’t report crypto losses?

Crypto exchanges like Coinbase written report information to the IRS, and crypto investors have received IRS letters recommending that individuals study their crypto taxes and/or pay more than taxes.

Many of the leading exchanges ship crypto 1099s to investors who take had more $600 of rewards income, meaning that the IRS volition as well receive a report of each trader’s activity.

Additionally, even exchanges who practise not send 1099s tin be compelled to share information with the IRS through a John Doe summons, an investigative tool increasingly used past the Biden assistants.

The information the IRS receives from these exchanges is often incomplete, nonetheless.

For example, if you bought bitcoin on Coinbase, transferred it to a separate strange crypto exchange, and incurred losses on that other commutation before sending bitcoin back to Coinbase to sell it for USD, then the IRS may simply account for that BTC sale.

In this case, the bureau doesn’t accept the information to know that you lot take an overall capital loss with crypto.

By accurately calculating your crypto taxes and reporting them to the IRS on Grade 8949 and Schedule D, you can show that you lot do not have whatever net majuscule gains that should be taxed.

I hold crypto at a loss but haven’t sold it. Tin can I merits the loss?

In society to claim a loss, you lot will need to have fabricated a crypto taxable event on the asset—this means selling information technology, trading it for some other crypto, or spending information technology. Otherwise, the loss remains unrealized and thus cannot exist reported every bit a capital loss.

With crypto tax-loss harvesting, you can pinpoint unsold assets that are at a loss before the end of the tax year. For example, if yous invested in many ICOs, yous may be holding some coins that you can sell off to claim the loss and lower your tax liability.

Afterward ensuring that y’all

meet the weather condition for tax-loss harvesting,

y’all may desire to larn about the TokenTax plans that include access to our Tax Loss Harvesting Dashboard, which allows you to apace and easily realize losses in order to reduce your revenue enhancement liability.

For more info on crypto tax nuts, visit our Crypto Tax Guide.

Challenges of reporting your crypto taxation losses on your taxation return

Calculating and reporting losses for each of your cryptocurrency trades in a revenue enhancement year can be tiresome and painstaking. It tin can also be troublesome to generate gains and losses reports when you have transferred crypto between wallets (such every bit Coinbase and Binance), considering exchanges may not know the original price basis of the transferred coin.

Report your capital losses with crypto tax software

TokenTax offers a solution to the various difficulties associated with reporting crypto revenue enhancement losses.

With our unique software, you tin calculate upper-case letter gains totals using diverse crypto accounting methods (including FIFO, LIFO, HIFO, the average cost method, or TokenTax’due south proprietary Minimization), assuasive you lot to reduce your tax liability. It doesn’t matter where in the world you are – TokenTax volition ensure that your tax render is compliant with your land’southward regulations!

If you would like to speak to our squad almost choosing a plan that is right for you, please contact us at

[email protected].

To learn more virtually TokenTax or to sign upwardly, visit: https://tokentax.co/pricing

Oftentimes Asked Questions

Exercise y’all pay taxes on crypto losses?

The short answer is no. If you take an nugget that yous hold at a loss, you need to realize the loss or sell the nugget. If you have not sold the asset, information technology remains unrealized.

When y’all realize a capital loss, that loss volition be tracked, and it will add together to your total capital losses. Your losses can be used to lower your capital letter gains through a process known as tax-loss harvesting.

Practise you have to report crypto losses to the IRS?

Yeah, the IRS requires that y’all study all sales of crypto, as it considers cryptocurrencies to exist property.

How practice I not pay taxes on crypto?

You generally do not owe taxes on cryptocurrency until you sell. That means that you can avoid paying taxes on crypto past non selling whatever virtual currency in a given tax year.

You can also employ these tips and instructions from Forbes Counselor to minimize your taxes on crypto.

What tax percent exercise yous pay on crypto upper-case letter gains?

Brusk-term upper-case letter gains are typically taxed as ordinary income at a rate between 10% and 37% in 2022. Long-term capital gains are typically taxed at preferential long-term majuscule gains rates of 0%, xv%, or 20% for 2022.

Source: https://tokentax.co/blog/how-to-report-crypto-losses-on-your-taxes

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media