Bitcoin is an immensely popular cryptocurrency in the market place currently. However, it is as well difficult to mine and volatile in price since it is decentralized and non regulated past a centralized banking company or government. Simply, if y’all own Bitcoin and want to make a profit out of your Bitcoin past selling it, you may demand to convert your Bitcoin to cash for buying real things.

In that location are numerous options available for you to cash-out Bitcoin, such as peer-to-peer exchanges or through third-party exchanges, bank transfers, PayPal, or greenbacks deposits. Yous can check out all the options earlier opting for any method.

In this tutorial, yous will acquire:

- How to turn Bitcoin into Cash using Binance P2P

- Why Transfer Bitcoin to Your Banking company Account?

- Factors to consider when cashing out Bitcoin

- Other Methods to Cash in Bitcoin:

- Method i: Using a Cryptocurrency Substitution

- Method two: Using Peer-to-Peer Exchange

- Method 3: Using Bitcoin debit cards:

- Method iv: Using Bitcoin ATMs

How to turn Bitcoin into Cash using Binance P2P

Here is the pace-by-step procedure to turn Bitcoin into cash:

Step 1)

Visit: https://www.binance.com/en/

Log in or Sign upwardly using your credentials and verify your business relationship details

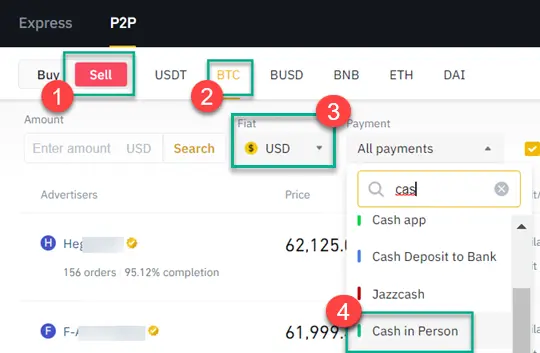

Step 2) Select the P2P Trading selection

- Select Sell

- Select BTC

- Select the fiat currency you want to cash out for. For case, if you are located in Russia, select Rubble. Here, we take selected USD.

- In Payment way, select

Cash in Person

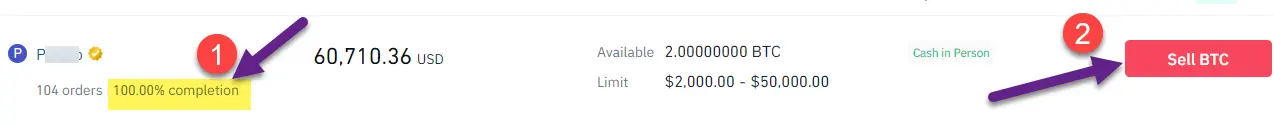

Step iii) On the next screen, you tin can run across that multiple advertisers offer to buy BTC in Greenbacks:

- It is advisable to select advertisers with a High Completion rate

- Click on the Sell BTC push button

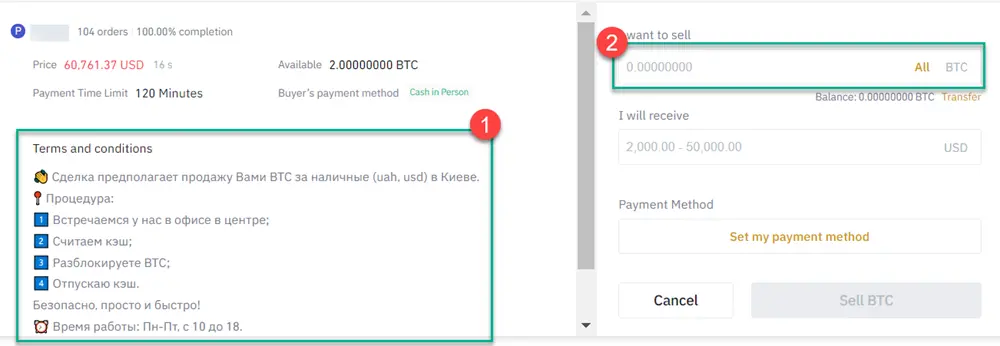

Pace 4)

Bank check the terms and conditions

- Become through the Terms & Weather of the Buyer. Many a time, buyers provide their contact data. It’s prudent to call them earlier confirming the merchandise.

- Once the deal is fix, enter the BTC you lot want to sell and press the Sell BTC push.

Step 5)

1 to One Run across

You will be able to meet the buyer in person, count the cash and release the BTC. For this purpose, the Binance mobile app would be handy to turn your Bitcoin into cash.

Why Transfer Bitcoin to Your Bank Account?

The idea behind transferring Bitcoin to a bank business relationship is that it will be able to supervene upon traditional currencies. Present, more than people are investing in Bitcoin every bit they view it as a commodity that will grow in value over time as the demand for Bitcoin is increasing day past mean solar day.

If you have Bitcoin, you may want to hold on to information technology for that reason. Nevertheless, you tin make a expert profit if you ‘sell’ your Bitcoin now and transfer an equal amount of money into your bank account.

There might exist a time when you will be able to use Bitcoin for any buy. For now, there are only a very few businesses and individuals who take payments in Bitcoin. That is also a reason you may want to convert your Bitcoin to purchase physical things.

Factors to consider when cashing out Bitcoin

Here are some crucial factors to consider when cashing out Bitcoin:

Transactional costs on P2P platforms:

P2P platforms allow you to merchandise hundreds and thousands of dollars in crypto. Nevertheless, P2P platforms also have very depression transactional limits and very loftier transactional fees. This may eat a sizeable amount when trading millions or a moderate amount of dollar value in Bitcoin. For example, you can’t merchandise across $1000 per day on most peer-to-peer(P2P) exchanges. Binance P2P withal, has no transactional fee on its P2P as well no limits.

Restrictions on trading and withdrawal amounts:

You tin trade Bitcoin using peer-to-peer trading. However, cashing out a large amount of Bitcoin comes with certain restrictions on daily withdrawals on many third-party crypto trading platforms. Besides, the possibility of scrutiny tin’t exist denied.

Applied limits for daily trading are likewise imposed when crypto trading with different payment methods. For case, the trading limits on LocalBitcoins is a maximum of 200,000 Euros per year for tier 2 KYC verified done. However, Tier 3 verified accounts may not have whatever specific limits imposed.

Regulatory scrutiny:

Cashing out Bitcoin tin create a considerable amount of wealth. That’southward why big transactions certainly concenter the attention of banks when done using that system. So, it is probable that those bank accounts may get blocked out because of suspicious money laundering activities.

Taxes:

In countries where upper-case letter gains are taxable, cashing out or selling whatever size of the crypto would be counted for tax reporting. It is not always an event for traders or holders with negligible sums.

However, large investors and corporate giants face such issues when trading large amounts of cryptocurrencies. They may take to pay huge sums in taxes where capital gains are taxable.

Speed:

Third-political party broker exchanges might take at least ii days to transfer the coin to deposit into your bank account. So, you lot should select an substitution where you lot can plough your Bitcoin into Cash in a fast and reliable manner.

Other Methods to Cash in Bitcoin:

Here are dissimilar ways to cash-out Bitcoin:

Method 1: Using a Cryptocurrency Exchange

A crypto exchange is just another proper noun for a tertiary-party banker. Many cryptocurrency exchanges don’t permit you to eolith funds using fiat currency. However, some of them exercise.

You demand to deposit your Bitcoin in the exchange. Once the exchange has received Bitcoin, you lot can immediately request a fiat currency withdrawal. The widely used method is to use a bank transfer.

Withal, y’all need to make sure that you do not break coin laundering laws. You lot must withdraw the corporeality to the same bank business relationship that you deposited with before. However, if you lot have never deposited fiat onto a banker exchange, you should first make at least i eolith.

Here are some exchanges when you tin can cash out your Bitcoins:

1) Coinbase

Coinbase is a cryptocurrency commutation where you tin purchase, sell, transfer, and store digital currencies. It deeply stores a wide range of digital avails in offline storage. This crypto exchange platform is supported in more 100 countries.

Withdrawal Methods:Bank Eolith, Credit/Debit Card: Visa and Mastercard and P2P Trading.

Fees:Instant Bill of fare Withdrawal: Upwards to 1.5% of the transaction plus a minimum of $0.55.

Cash-out times:United states withdrawals ordinarily take 4-6 working days, while Euro withdrawals accept ane-3 days.

Visit Coinbase >>

two) Binance:

Binance is 1 of the widely popular crypto trading exchanges. Information technology offers a platform for trading more than 150 cryptocurrencies. Information technology provides an API that helps you to integrate your current trading application.

Withdrawal Methods: Banking company Deposit, Credit/Debit Card: Visa and Mastercard and P2P Trading.

Fees:Instant card withdrawal transactions charge a fee of 1%. The minimum withdrawal amount is 10 EUR.

Greenbacks-out times: In about cases, your withdrawal request will be processed inside 5 minutes. Even so, processing time can have up to 24 hours in some rare cases.

Visit Binance >>

Method ii: Using Peer-to-Peer Exchange

P2P Bitcoin greenbacks exchange works like an escrow service. It helps yous to securely buy or sell Bitcoin. Here are the two most prominent P2P exchanges to greenbacks out Bitcoins:

1) LocalBitcoins

LocalBitcoins is a P2P crypto trading site that allows people from different countries to buy and sell Bitcoin using their local fiat currency. It is a non-custodial P2P marketplace that helps users to buy unlimited amounts of Bitcoin.

LocalBitcoin as well offers escrow protection to make certain the Bitcoins and both traders are safe. This P2P crypto trading exchange is bachelor in more than than 200 countries.

Withdrawal Methods: PayPal, Wire transfer, Western Union Webmoney, Cash by mail, Cash (done in person), etc.

Fees:At that place are no fees for registering, ownership, or selling cryptocurrency. Users who create advertisements are charged 1% of every completed trade.

Cash-out times: LocalBitcoins takes a maximum withdrawal fourth dimension of 12 hours.

Visit LocalBitcoins >>

2)

LocalCryptos

![]()

LocalCryptos is a cryptocurrency commutation which allows you to purchase Bitcoin on cryptocurrency platforms. Information technology has buyers and sellers in approximately 15,000 cities worldwide. It offers terminate-to-end encryption. Using a not-custodial peer-to-peer platform keeps y’all in control and protects your wallet from theft. Information technology too provides numerous payment methods.

Withdrawal Methods: Transferwise, Revolut, PayPal, Moneygram, and Skrill.

Fees:LocalCryptos charges a 0.25% maker fee (the person who posted the offering) and a 0.75% taker fee (the person who responds to the offering).

Visit LocalCryptos >>

Method 3: Using Bitcoin debit cards

Many websites let yous to greenbacks out your Bitcoin through a prepaid debit carte. Yous can use this carte du jour like the normal debit menu powered by Mastercard or Visa.

The all-time thing about using a Bitcoin debit menu is that information technology works for online and offline shopping in almost every business. These debit cards tin can withdraw cash from ATMs where these cards are accepted.

Example:

https://www.binance.com/en/cards

Method iv: Using Bitcoin ATMs

Although it looks like a traditional cash machine, Bitcoin ATMs are not traditional ATMs. In place of connecting to the trader’s bank account, they are directly connected to the Net to behave out Bitcoin transactions.

Bitcoin ATMs let you to browse QR codes and then sell your Bitcoin for cash. These ATMs are located across the world. Their locations can be found easily on the Cyberspace.

However, you lot should call back that they normally charge loftier transaction fees compared with other cash-out methods. Moreover, not every Bitcoin ATM offers to purchase and sell functionality.

FAQ:

❓ What are the legal and statutory risks in cashing out Bitcoin?

Hither are some legal and statutory risks in cashing out Bitcoin:

- In some countries, cryptocurrency is seen as currency, but not in The states. Information technology is considered every bit holding and is therefore taxed. Investors in crypto are required to pay capital letter gain taxes irrespective of where they bought the cryptocurrency.

- Businesses that are accepting cryptocurrencies do not currently need to register or obtain a license to do so. However, at some signal, they might, including the correct to operate in sure jurisdictions.

- Because of the decentralized nature of Bitcoin, in that location is a higher risk of fraud. And so, crypto investors who take been defrauded will not accept the aforementioned legal pick every bit traditional fraud victims.

✔️ What’due south the Best Way of Cashing Out Bitcoin?

Here are some of the best ways of cashing out Bitcoin:

-

Using a Cryptocurrency Substitution:

A crypto exchange is but another name for a third-party broker. Some cryptocurrency exchanges similar Coinbase and Binance allows you to deposit funds using fiat currency -

Peer-to-Peer Substitution:

P2P crypto trading sites like LocalCrypto and LocalBitcoins allows people from different countries to buy and sell Bitcoin using their local fiat currency -

Bitcoin debit cards:

Many websites permit you to cash out your Bitcoin through a prepaid debit card. You tin use this Bitcoin debit card powered by Mastercard or Visa -

Bitcoin ATMs:

Bitcoin ATMs allow you to browse QR codes and then sell your Bitcoin for greenbacks. These ATMs are located beyond the world

Source: https://www.guru99.com/how-to-turn-bitcoin-into-cash.html

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media