Welcome to Level v!

Information technology’s safe to say y’all are serious virtually becoming a knowledgeable investor. Now, are you ready to take on a new challenge? Now things volition become technical. We’re nearly to dig deeper into the wonders of technical analysis and explore some of the about pop tools used by stock traders.

So, let’s starting time with a elementary and highly effective technical analysis tool – back up and resistance levels!

What is Support and Resistance in Stocks?

Support and resistance is one of the most widely used tools amidst stock traders that help them identify possible points on stock charts where the stock cost is likely to change direction.

By studying these two levels, stock traders and investors (and other market participants) can better understand what is happening in the stock market place and find many trading opportunities. It’s all about price action and those price drops, price breaks, and price highs! Farther, recollect that back up and resistance price levels tend to be round numbers or near them.

Bear in heed that there are different techniques for using support and resistance lines. One way is to discover a trading range where prices consolidate inside support and resistance levels.

Traders typically employ this trading strategy when a stock is traded sideways to purchase the asset at the bottom (the support price level) and sell it at the resistance level. When the cost breaks the support or resistance, and then you get a bespeak for a new trend.

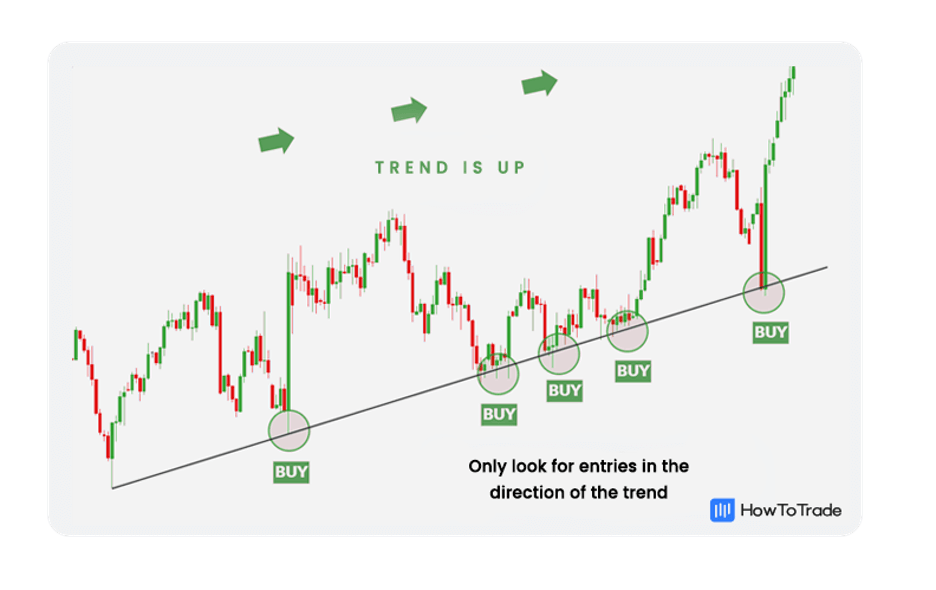

Some other manner to use support and resistance is during an ongoing trend. In this way, traders notice a support or resistance level in an existing tendency and detect opportunities to enter a trade and join the trend.

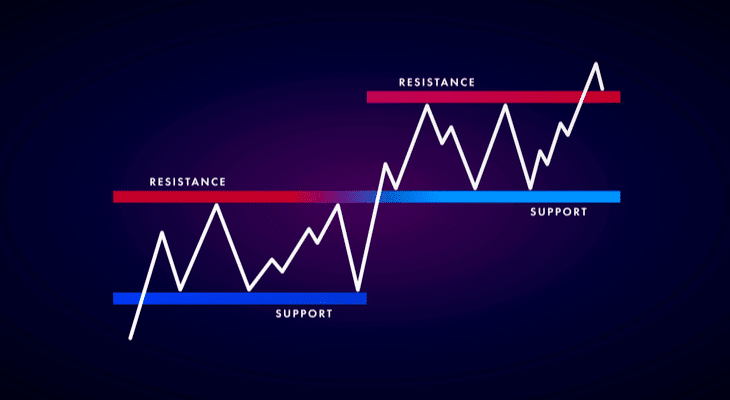

A motion picture, or well a zigzag pattern for us, paints a 1000 words so permit’s take a look at what Support and Resistance look similar.

As yous tin can see, back up and resistance are basically horizontal lines on a price chart that are placed in areas where prices cannot interruption below or higher up these levels. Traders use this trading technique when they await the price to stay within the trading range or buy or sell the nugget when the toll breaks below or above the support or resistance level.

Cartoon a Support Level

The support level tin be spotted at the bespeak on a nautical chart where the stock prices stop falling (or, as traders say, the price reaches the lesser), change direction, and brainstorm to rise.

Traders often refer to support equally the ‘floor’ every bit it is the everyman level, the ground holding the stock prices from falling beneath information technology. Simply put, when you identify support levels at which prices cannot break below information technology at least twice, then this is a back up level, and you lot draw a horizontal line using a drawing tool bachelor on your trading platform.

Why Are Back up Levels Important?

Support levels indicate where there will be a surplus of buyers for the specific stock or share, and these usually signal exit or entry points for many traders.

At this point, you can wait to become an indication of the next cost motility. If the toll cannot break below the back up level, you will buy the asset and bring together the trend. Otherwise, you volition exit your merchandise or enter a brusk selling position if the stock’s price breaks the back up level.

Drawing a Resistance Level

Resistance can be spotted at the point on a nautical chart where the stock prices stop rising, change direction, and begin to fall. Traders ofttimes refer to resistance as the ‘ceiling’ that keeps the prices from rise higher.

Like a support level, you’ll have to draw a horizontal line or a tendency line where prices cannot break a certain resistance level.

Why Are Resistance Levels Important?

Resistance levels indicate where there volition be a surplus of sellers for the specific stock or share. The stronger the resistance, the smaller the take chances that the downtrend will go on.

In other words, to make information technology even simpler, support levels advise that the stock prices are unlikely to fall below the line, while resistance levels betoken that the stock prices are unlikely to rise higher up the line. Yet, when the price eventually breaks to a higher place a resistance level, you get a solid indication to enter a long position merchandise.

Why Should You Utilise Support and Resistance Levels?

Identifying Back up and Resistance levels is crucial for your trading success. They are 1 of the well-nigh pop technical analysis tools amongst traders, and for a good reason (of not only the stock market just other financial markets too).

In fact, I could write 18 pages, front and back, on why support and resistance play a pregnant role in technical analysis. Also, if y’all are keen to aggrandize your cognition, you tin find more data most support and resistance levels by reading one of the top trading books.

At present, to make it short and sugariness earlier we are washed, allow me put it this way. Stock traders can more accurately predict futurity marketplace movements by analyzing the support and resistance levels. Armed with this information, traders and investors can potentially find price levels (or price points) to enter or shut a position.

The good matter with support and resistance is that it’s not complicated to apply this tool, and information technology’due south a reliable indicator. After all, many traders expect at the same numbers and the aforementioned trading charts; therefore, these cost levels go even more than important when making trading decisions.

Further, many traders use level ii society volume, and order blocks to make this trading strategy successful.

How to Depict Support and Resistance Levels – A Stride by Step Breakdown

Okay, so now that yous know what support and resistance levels are, let’s take a look at how y’all tin identify and draw them on price charts. And then, here are the 3 steps to depict support and resistance levels with boosted essential tips.

i. Open up up your favorite chart type!

First, you demand to open up a trading chart on any financial musical instrument you lot want to focus on. Candlesticks, Bar Nautical chart, or Line Chart – information technology’s entirely upward to you to determine. Support and Resistance work with all. In our case, we volition be using a Candlestick Chart.

2. Identify and draw horizontal lines at support and resistance levels

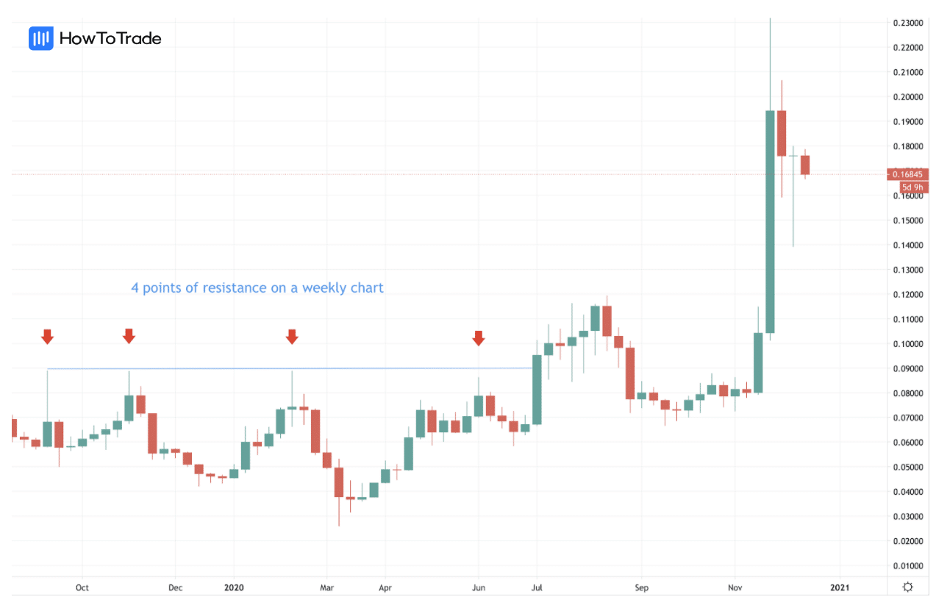

Now, you need to find back up and resistance levels. To do that, y’all need areas where the price cannot break a certain level at to the lowest degree two times. Just recall, the more, the better.

Then, on any advanced trading platform, you tin observe you have drawing tools. To depict support and resistance levels, locate the drawing tool and employ either a trend line or horizontal (depending on where y’all will depict support and resistance levels).

By drawing these lines, yous can clearly see whether the market is in a trend or a range mode. To describe a horizontal line on your chart, select the horizontal line button on your toolbar and click anywhere on the chart where you want the line to appear. Eventually, your nautical chart should look like this:

3. Merchandise stocks using back up and resistance levels

Lastly, after you lot have identified support and resistance levels, it’s time to enter a merchandise. At bones, traders usually buy the nugget near the support level and sell the asset near the resistance level. To be honest, it’southward fairly uncomplicated.

Another common trading strategy is trading breakouts. In this case, you’ll enter a trade when the stock price breaks below or above the support and resistance levels.

Either way, there is one matter you need to keep in mind – placing a end loss. The advantage of trading with support and resistance is that placing a stop club is clear and straightforward. You just place your stop loss order below the support level or above the resistance level. Moreover, many traders use the stop level every bit an indicator to enter an reverse trade.

Summary

In determination, the concept of support and resistance zones (or levels) acts as a foundation for many advanced trading strategies in the stock market. As y’all tin conclude from this lesson, there are various ways for technical traders to use these levels in their trading strategies, and information technology is entirely upward to you lot to choose how and when you will use support and resistance levels.

As a tip – utilise this trading strategy. Support and resistance levels are amidst the most valuable trading tools a trader tin can employ. It’s easy to utilize and highly reliable if you lot learn how to use it correctly.

Become your gratis access today to bring together our academy to career funded trader programme

Source: https://howtotrade.com/courses/trading-with-popular-stock-indicators/stocks-support-and-resistance/

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media