Fearfulness and Greed Alphabetize

An index used to gauge investor sentiment on the stock market

What is the Fear and Greed Alphabetize?

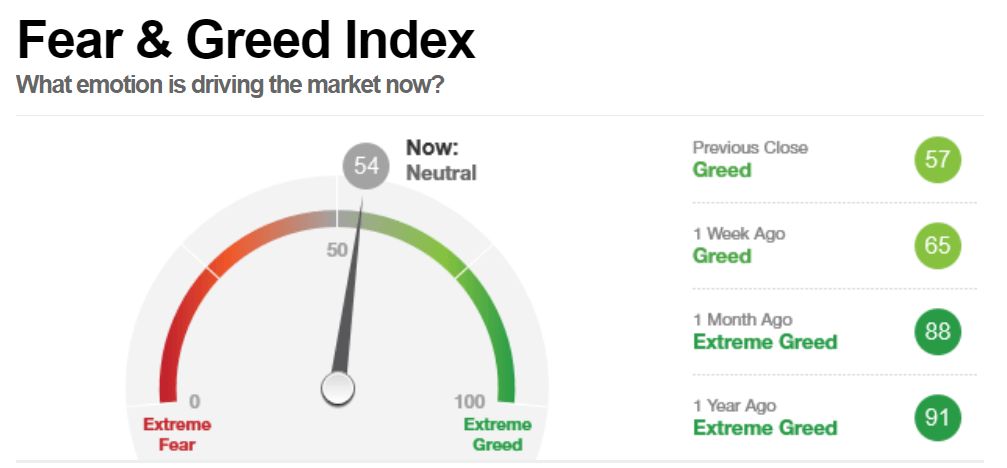

The Fear and Greed Index, developed by CNNMoney, is used to gauge whether investors are also bullish or bearish on the stock marketplace. The index ranges from 0 (extreme fearfulness) to 100 (extreme greed).

Summary

- The Fear and Greed Index is a tool used to gauge investor sentiment on the stock market.

- The index is based on seven dissimilar factors – each cistron is gauged from 0 to 100 and as weighted to generate the index value.

- It is seen as less of an investment enquiry tool and more of a marketplace-timing tool.

Understanding the Fear and Greed Index

In theory, the Fearfulness and Greed Index acts as a barometer for whether the stock marketplace is fairly priced past looking at the emotions of investors. Information technology is seen as a contrarian index.

When investors are fearful, they sell stock holdings in their portfolio, driving downward stock prices to the point where they may exist below their intrinsic value. The opposite is truthful when investors are greedy. As such, for the Index, fear is seen equally a purchase indicator, and greed is seen every bit a sell indicator.

A fear and greed rating of:

-

0 to 49

indicates fear -

50

indicates neutral -

51 to 100

indicates greed

Calculation of the Fear and Greed Index

The Fright and Greed Index is based on seven different factors – each cistron is gauged from 0 to 100 and equally weighted to generate the index value. The seven factors are:

i. Stock Cost Strength

The number of stocks on the New York Stock Substitution (NYSE) hit 52-week highs relative to those striking 52-calendar week lows. A greater number of stocks hit 52-calendar week highs versus 52-weeks lows indicates greed and vice versa.

ii. Stock Price Latitude

The trading volumes of ascension stocks relative to failing stocks on the NYSE. Greater trading volumes in ascent stocks versus declining stocks indicate greed and vice versa.

iii. Market Momentum

The operation of the S&P 500 relative to its 125-day average. A greater relative performance indicates greed and vice versa.

iv. Put and Call Options

The Chicago Board Options Commutation put/phone call ratio. A higher put/call ratio indicates fear and vice versa.

v. Safe Haven Demand

The performance of stocks relative to bonds. Greater relative functioning indicates greed and vice versa.

6. Junk Bail Demand

The yield spread between investment-form bonds and junk bonds. A greater yield spread indicates lower junk bond demand (signals fear) and vice versa.

7. Market Volatility

The Chicago Board Options Substitution (CBOE) Volatility Index (“VIX”). A college VIX value indicates fright and vice versa.

Using the Fear and Greed Index

The Fright and Greed Index is commonly used to fourth dimension entry into the marketplace. As such, the Index is seen as less of an investment research tool and more of a market-timing tool. As stated past Warren Buffet, “Be fearful when others are greedy, and greedy when others are fearful.”

For example, when the index hits a value of xc (extreme greed), it may signal that stocks are overvalued. Information technology may prompt investors who follow the index to sell their stock holdings.

Applied Examples

Question 1: On September 29, 2008, the Dow closed 778 points downward, reflecting a seven% loss. Would you presume that the Fear and Greed Alphabetize took on a value of (a) twenty, (b) lx, or (c) 90 on that 24-hour interval?

Respond 1: The Index likely assumed a value of twenty on that mean solar day, as the steep decline would likely reflect fear by investors.

Question 2: Tim is looking to invest in the stock market. Despite his investment advisor advising him not to time the market, Tim thinks otherwise. Based solely on the Fright and Greed Index, which is currently at 95, is information technology likely that Tim will deploy his capital letter today?

Answer 2: Since Tim is looking to fourth dimension entry into the market, he would likely be looking for a depression Fear and Greed Index before deploying his capital. As such, given a value of 95 (extreme greed), information technology is unlikely that Tim will deploy his capital today.

More Resources

Cheers for reading CFI’southward guide on Fear and Greed Alphabetize. To go along advancing your career, the additional CFI resource below will be useful:

- Contrarian

- Junk Bonds

- Options: Calls and Puts

- Volume of Trade

- See all equities resource

- Encounter all wealth management resources

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media