Is Cryptocurrency a Good Investment?

Investing in virtual currency has produced jaw-dropping returns for some, but the field still presents risks.

By Anders Bylund – Updated Oct xix, 2022 at eleven:05AM

Information technology is possible to get filthy rich past investing in cryptocurrency — just information technology is as well very possible that you lose all of your money. Investing in crypto avails is risky, but can be a proficient investment if you do it properly and as part of a diversified portfolio.

Cryptocurrency is a good investment if y’all want to proceeds direct exposure to the demand for digital currency. A safer but potentially less lucrative alternative is buying the stocks of companies with exposure to cryptocurrency.

Epitome source: The Motley Fool

Let’due south examine the pros and cons of investing in cryptocurrency.

Is cryptocurrency safety?

Multiple factors show that cryptocurrency is non ever a prophylactic investment. All the while, other signs are emerging that cryptocurrency is hither to stay.

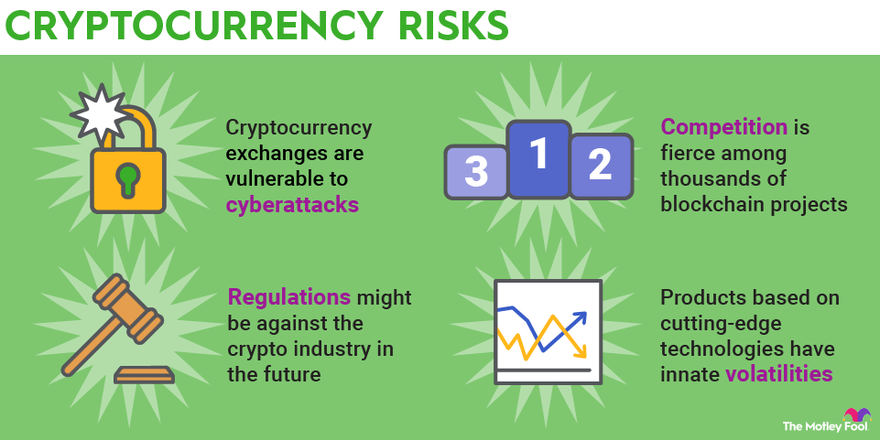

Cryptocurrency risks

Cryptocurrency exchanges, more and then than stock exchanges, are vulnerable to being hacked and condign targets of other criminal action. Security breaches accept led to sizable losses for investors who have had their digital currencies stolen, spurring many exchanges and tertiary-party insurers to begin offering protection against hacks.

Safely storing cryptocurrencies is also more than difficult than owning stocks or bonds. Cryptocurrency exchanges such as

Coinbase

(NASDAQ:Coin) make it adequately easy to buy and sell crypto assets such as

Bitcoin

(CRYPTO:BTC) and

Ethereum

(CRYPTO:ETH), simply many people don’t like to keep their digital assets on exchanges due to the risks of allowing any company to control access to their assets.

Storing cryptocurrency on a centralized exchange ways you lot don’t accept total control over your assets. An exchange could freeze your avails based on a government request, or the commutation could go broke and y’all’d have no recourse to recover your coin.

Some cryptocurrency owners prefer offline “common cold storage” options such equally hardware wallets, but cold storage comes with its own set of challenges. The biggest is the take chances of losing your private key; without a central, it’s impossible to admission your cryptocurrency.

In that location’s also no guarantee that a crypto project you invest in will succeed. Competition is violent among thousands of blockchain projects, and many projects are no more scams. Only a small-scale percent of cryptocurrency projects will ultimately flourish.

Regulators may besides crack down on the entire crypto manufacture, particularly if governments view cryptocurrencies as a threat rather than an innovative technology.

The cutting-edge technology elements of cryptocurrency also increment the risks for investors. Much of the tech is still being developed and is not withal extensively proven in real-earth scenarios.

Cryptocurrency adoption

Despite the risks, cryptocurrencies and the blockchain industry are growing stronger. Much-needed financial infrastructure is existence built, and investors are increasingly able to admission institutional-grade custody services. Professional person and private investors are gradually receiving the tools they demand to manage and safeguard their crypto avails.

Crypto futures markets are being established, and many companies are gaining direct exposure to the cryptocurrency sector. Financial giants such equally

Block

(NYSE:SQ) and

PayPal

(NASDAQ:PYPL) are making information technology easier to buy and sell cryptocurrency on their popular platforms. Other companies, including Cake, have poured hundreds of millions of dollars into Bitcoin and other digital assets.

Tesla

(NASDAQ:TSLA) purchased $1.5 billion worth of Bitcoin in early on 2021. Past February 2022, the electrical vehicle maker reported that information technology held well-nigh $2 billion of the cryptocurrency.

MicroStrategy(NASDAQ:MSTR) — a business organization intelligence software visitor — has been accumulating Bitcoin since 2020. It held $5.7 billion in the cryptocurrency past the end of 2021 and said it plans to purchase more with backlog cash generated from operations.

Although other factors still bear upon the riskiness of cryptocurrency, the increasing pace of adoption is a sign of a maturing manufacture. Individual investors and companies are seeking to gain direct exposure to cryptocurrency, considering it safe enough for investing large sums of money.

Is crypto a adept long-term investment?

Many cryptocurrencies such equally Bitcoin and Ethereum are launched with lofty objectives, which may be achieved over long time horizons. While the success of any cryptocurrency project is not bodacious, early on investors in a crypto project that reaches its goals tin be richly rewarded over the long term.

For any cryptocurrency project, notwithstanding, achieving widespread adoption is necessary to be considered a long-term success.

Bitcoin as a long-term investment

Bitcoin, as the most widely known cryptocurrency, benefits from the network consequence — more people desire to own Bitcoin because Bitcoin is owned by the most people. Bitcoin is currently viewed past many investors as “digital aureate,” but it could besides exist used as a digital form of greenbacks.

Bitcoin investors believe the cryptocurrency will gain value over the long term considering the supply is fixed, different the supplies of fiat currencies such as the U.S. dollar or the Japanese yen. The supply of Bitcoin is capped at fewer than 21 million coins, while almost currencies can be printed at the will of central bankers. Many investors wait Bitcoin to gain value every bit fiat currencies depreciate.

Those who are bullish about Bitcoin being extensively used as digital greenbacks believe it has the potential to become the first truly global currency.

Ethereum every bit a long-term investment

Ether is the native coin of the Ethereum platform and can exist purchased past investors wishing to gain portfolio exposure to Ethereum. While Bitcoin can be viewed every bit digital gilt, Ethereum is building a global computing platform that supports many other cryptocurrencies and a massive ecosystem of decentralized applications (“dApps”).

The large number of cryptocurrencies built on the Ethereum platform, plus the open up-source nature of dApps, creates opportunities for Ethereum to as well benefit from the network effect and to create sustainable, long-term value. The Ethereum platform enables the apply of “smart contracts,” which execute automatically based on terms written directly into the contract lawmaking.

The Ethereum network collects Ether from users in exchange for executing smart contracts. Smart contract engineering has pregnant potential to disrupt massive industries such as real estate and banking and too to create entirely new markets.

As the Ethereum platform becomes increasingly used worldwide, the Ether token increases in utility and value. Investors bullish on the long-term potential of the Ethereum platform can profit direct by owning Ether.

That’s non to say Ethereum doesn’t have competition. A number of “Ethereum Killers,” including

Solana

(CRYPTO:SOL),

Polygon

(CRYPTO:MATIC), and

Avalanche

(CRYPTO:AVAX), are all built to handle smart contracts and utilise a blockchain system capable of processing more transactions per 2d. The speed has the added advantage of existence less expensive for users also. Just Ethereum is the most broadly adopted platform for using smart contracts.

Should y’all invest in cryptocurrency?

Owning some cryptocurrency can increase your portfolio’s diversification since cryptocurrencies such as Bitcoin take historically shown few price correlations with the U.S. stock market. If yous believe that cryptocurrency usage will become increasingly widespread over time, then information technology probably makes sense for you to buy some crypto directly as office of a diversified portfolio. For every cryptocurrency that you invest in, exist sure to accept an investment thesis as to why that currency will stand up the test of time. If you exercise your research and larn as much every bit possible about how to invest in cryptocurrency, you lot should exist able to manage the investment risk equally part of your overall portfolio.

If buying cryptocurrency seems also risky, y’all tin consider other means to potentially profit from the rise of cryptocurrencies. You lot can purchase the stocks of companies such as Coinbase, Block, and PayPal, or you lot can invest in an commutation similar

CME Grouping

(NASDAQ:CME), which facilitates crypto futures trading.

Expert Q&A

The Motley Fool: What advice would you give to someone interested in investing in blockchain technology?

Parlour:

Be curious but also be cautious. It is important to recognize that there is not a complete regulatory framework in this area. So, it is important to do your homework. First, consider the venue that y’all utilize to admission the market. At that place are regulated crypto exchanges and trading places; however, there are also unregulated ones. 2d, while about tokens are based on open-source code, information technology is not the case that they take the aforementioned disclosure regimes as blueish chip stocks. And then, exist careful and investigate the nature of the underlying token. Annotation that in other countries (Canada, Europe), there are ETFs and ETPs that rails crypto portfolios; these have non received regulatory approval yet in the U.Southward. If and when they are offered to consumers, these will exist a depression-toll way of accessing the crypto market place, and then someone else volition handle the marketplace mechanics.

The Motley Fool: What communication would you give to someone interested in investing in blockchain engineering science?

Dr. Ozair:

Blockchain engineering science is definitely the future. There is no escaping that. However, it is difficult to predict which projects will last and which will fail and be forgotten.

Well-nigh blockchain engineering science companies are in their early, if not very early on, stages. Hence, investing in companies utilizing blockchain technologies has all the same risks as investing in a start-up. And similar in any first-up, the take chances-reward ratio is high.

Therefore, larn nearly blockchain technology, do a thorough due diligence on any project — from its technology to business organization model to execution. Learn about the “trouble” it is trying to solve and what solution it’s offering — both from a technological perspective and a business perspective.

There’s a lot of potential with blockchain engineering science, but the execution is in the details.

The Motley Fool: Which industries, other than finance, exercise you retrieve blockchain has the potential to disrupt?

Dr. Ozair:

The time to come that I have been envisioning is that every product or service awarding we know today volition run on some form of blockchain technology. In other words, the “rails” of all products and services (i.e., the applied science that “runs” these applications) will be a type of DLT.

I truly believe that in 10 to 15 years, this would be feasible.

Similar the net, which has get a pivotal office of our everyday lives, and we cannot imagine life without it, so will DLT. When we use the internet, we exercise not ask ourselves – “How does it work?” or “Why should we apply information technology?” – nosotros just utilize it for the mobility, flexibility, efficiency and connectivity it provides. The COVID-19 pandemic has underscored the Net’s benefits. It enabled us to connect to services, products and people and facilitated a smooth transition to a remote, contactless global economy. Now Web ii.0 – Internet is evolving to Spider web 3.0 – Distributed Ledger Engineering science.

The Motley Fool: What innovations or trends in blockchain engineering are you lot about excited about?

Dr. Ozair:

The ecosystem of blockchain technology is evolving very chop-chop. Every twenty-four hours (literally) you learn near new applications and new business concern use cases that have utilized blockchain engineering science. Information technology is truly – slowly but surely – beingness implemented in any manufacture and any “traditional” application. From finance to healthcare to retail to fine art to education, the implementations are boundless.

The true ability of blockchain engineering science is its ability to facilitate services to underserved communities and genuinely to democratize society. That was the premise of Bitcoin, when it was commencement launched in January of 2009 – i.e., a peer-to-peer payment organization, and we somewhat lost focus on the main purpose of blockchain technology every bit” greed” got in the way.

The utilization of Decentralized Autonomous Organization (DAO) equally the governance of whatever blockchain arrangement and awarding, volition enable blockchain applications to provide the needs of the underserved communities, nationally and globally.

The Motley Fool: What advice would you give to someone interested in investing in blockchain applied science?

Lenz:

Learn and keep learning. The developments in the space are happening at a rapid pace, so much so that new knowledge is being generated constantly. As a professor teaching blockchain, this is the hardest office, reinventing the form every semester, but it keeps my students and me as electric current equally possible. This doesn’t mean neglecting base cognition; having this is crucial, every bit well as some sense of the history to sympathize why developments have occurred at specific times.

Anders Bylund has positions in Bitcoin, Coinbase Global, Inc., Ethereum, Solana, and Tesla. The Motley Fool has positions in and recommends Avalanche, Bitcoin, Block, Inc., Coinbase Global, Inc., Ethereum, PayPal Holdings, Polygon, Solana, and Tesla. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.

Related Articles

Source: https://www.fool.com/investing/stock-market/market-sectors/financials/cryptocurrency-stocks/is-cryptocurrency-good-investment/

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media