Article Summary:

A call option allows the investor to purchase avails at a previously stipulated price for a express menses of time. For this convenience, you must pay an option premium. If you lot don’t purchase stock within this timeframe, the selection expires and yous can no longer purchase the nugget for the specified toll. Depending on how the asset’s price changed during that time period, yous may lose just the option premium or the gains you would have made from the stock.

Options are a type of derivative contract that gives the buyer the right to buy or sell at a certain price. The cardinal hither is the word “right.” They accept the option, or the correct, to purchase a stock at a sure price but are past no means obligated to practice so.

Stock options finer give an investor the opportunity to bet on the futurity movement of a stock or asset price without being 100% obliged to invest in it. The two elements that are e’er present in a stock choice contract are an agreed-upon price, or strike price, and an agreed-upon date, or expiration appointment. The thought behind options is to diversify and hedge risk while taking advantage of upswings and downswings in the market place.

The two most common types of options are telephone call and put options. When you buy a call option, you pay for a contract that gives you the right to purchase a stock or nugget (chosen the underlying security) at an agreed-upon cost until the option expires. With put options, yous pay for a contract that gives you the correct to sell a stock or asset at an agreed-upon price before the expiration date. Later on that menstruation of time, the options expire.

Options and strike price

The most important aspect of an selection is that it gives yous the right to expect and see. When you lot buy a traditional stock or nugget, you pay for information technology upfront. You send your coin to the broker, and in render, you lot receive buying of the stock or nugget.

With an option, you pay for the correct to purchase or sell later at the strike price or sell the option at its intrinsic value. The agreed-upon price that yous exercise with an option is called the option’s strike price. One time your choice hits this strike price, you can exercise it.

This is important in the world of investing every bit information technology allows you to hedge gamble and non employ your capital upfront. To understand how this is important, permit’due south take a look at pick scenarios and examples.

Phone call selection

A phone call option is a derivative contract that allows an investor to buy an nugget at an agreed-upon price within an agreed-upon fourth dimension frame. They purchase this selection with the hope that the stock volition increase.

The strike cost will be the agreed-upon price that they will purchase the choice. The strike price on a call option will hopefully be much lower than what the marketplace value is when the stock increases.

Of import!

Continue in mind that each stock option, call or put, is for 100 shares of the underlying security.

Call option example

Let’southward say that you feel that wheat is going to be a commodity that you feel will be undersupplied in the near futurity. That beingness said, yous don’t want to put all of your coin into stocks and commodities related to wheat upfront.

Based on this assumption, you decide to invest in Wheat of the Globe, Inc. (WOW), which is currently listed on the Southward&P for $xx per share. You feel that this stock could easily double in six months. If you want to make a bet on WOW but desire to hedge, you would become a call choice contract and pay an “option premium” to have the right to buy WOW Inc. stock. The call option to buy gives you a strike price of $xx over iii month period.

WOW listing price = $xx

WOW call option strike price = $20

WOW telephone call option expiration engagement = 3 months

WOW option premium = $two

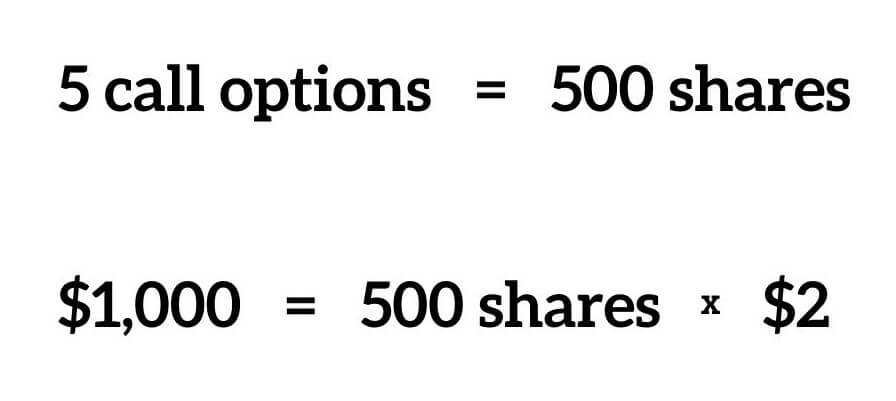

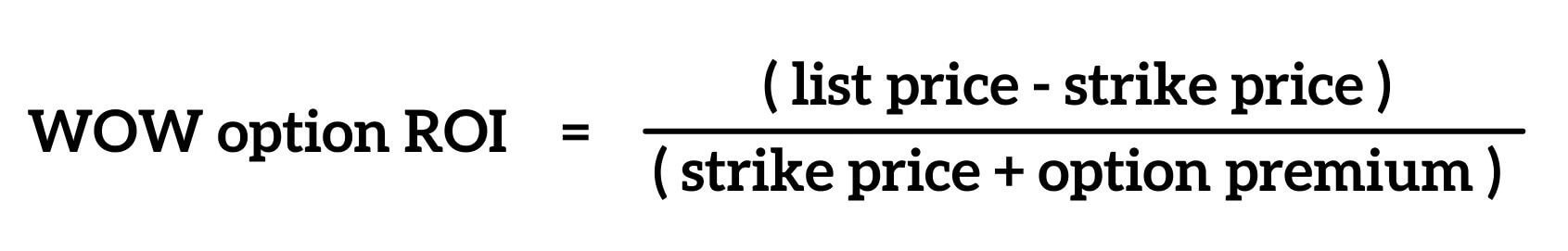

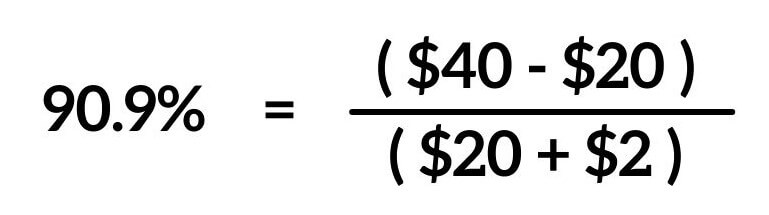

You buy five call options of WOW for $1,000 in total. At present permit’southward say that the price does indeed double to $twoscore per share in 2 months. Because your call option contract’due south timeframe is for iii months, yous tin can purchase it for the $twenty agreed-upon stock cost, plus the options premium. The ROI breakdown works as below:

WOW new listing cost = $forty

WOW call selection strike toll = $20

WOW option premium = $2

If you were to pay direct for WOW at the time you purchased your options, you would take doubled your investment with a return of 100%. However, that position would have cost $x,000 (500 shares x $20 per share). Instead, past taking out a call option, you are yet able to make a decent ROI while just risking $i,000. If, on the flip side, WOW were to decline by 20%, you would simply be on the hook for the option premium that you paid and would not lose the entire 20%.

If you prefer this style of investing, you may desire to consider opening an business relationship with one of the brokerages below, all of which deal in options.

Why do options accept a fourth dimension frame?

Options are only bachelor for a specific time frame. This has to exercise with risk calculations being formed by both parties. If an options writer sells you a call selection contract for an unlimited catamenia of time, this can run a great risk.

Example:

Let’southward say that your buy of WOW stock didn’t have a period of fourth dimension or a much longer period of fourth dimension. The stock might increase by 500% in 10 years.

If y’all exercised the option ten years from now, then the pick’due south writer would exist loathed to take a 500% loss on their books past selling you the stocks for fashion below marketplace value based on your options contract. But equally you analyze risk for investing, and so practice the options writers providing options contracts.

What happens when a call selection expires?

When an option contract expires, at that place are three definitive possibilities. They can elapse in the money, out of the money, and expire worthless.

In the money

If your phone call option has a strike price that is below what the current market place toll is, you are “in the money.” This means that you stand to make a profit based on the difference between the electric current market price and the strike price that was listed on your option. Y’all need to make certain y’all do the pick and then that y’all are able to obtain your profits before information technology expires.

If the call option expires and you are “in the money,” y’all lose two things:

- The premium that y’all paid for the option; and

- The lost profit yous would have made on the difference between the strike toll and the listing market toll.

In the WOW selection, you are losing both the $2 premium yous paid, as well as the opportunity to make a turn a profit from the difference between the strike cost and market cost. In this case, $20 (twoscore – 20 = 20).

Out of the money

Though you still lose some funds when a call selection expires “out of the coin,” this amount is smaller compared to what you would lose should your option elapse in the coin. If your option expires and you are out of the money, then the just money you would have lost would have been the premium.

For example, in the WOW scenario, you would lose the $2 premium y’all pay per share. When a phone call pick expires and it’s out of the coin, this is called, “expire worthless.”

Expire worthless

“Expire worthless” is a term used to define call options that exceed their expiration date. If an option expires worthless, there is no profit to be made on the option. The buyer loses the premium paid, and the option is now worthless.

Trading options and timing

Options acquit similar to the bodily underlying stocks, as you lot can merchandise the contracts, just like you lot can stocks. Options contracts volition increment or decrease in value on the trading market due to the state of the marketplace besides as the time of the expiration appointment.

For example, if the wheat market is booming, and you have a 3-month pick to purchase WOW stock, you lot will about probable get more than money for it if y’all sell it afterward two months than waiting for the concluding solar day of the last month to run into if the price continues to ascent. This is because the buyer of your options wants equally much fourth dimension earlier the expiration date to practise them as possible.

Options’ function in the 2008 financial crises

The power to practice financial options is directly tied to the ability of the choice’s writer to purchase or sell the options and pay out money. Typically, these options writers will take on the insurance that underwrites the contracts on an even deeper level. If the market place suffers from a systemic shock, such equally what happened in 2008, this whole structure tin can be in deep trouble and thus crave government intervention. This is because both the options writers and the insurance companies that underwrite insurance on options are in problem.

This is why AIG had to be bailed out during the financial crisis. AIG was known to most in the US as an insurance visitor that would insure things like family or home insurance. What virtually people didn’t know was that AIG insured the options that were related to betting on various parts of the housing marketplace. When the organisation crumbled, AIG was forced to take an $85 billion loan from the federal government in lodge to ensure its solvency.

FAQs

What happens if I don’t sell my call option on death?

If yous don’t sell your call pick on decease, then yous no longer take the right to buy the stock for to a higher place or below the current market place price. You lot also lose the premium paid for the asset.

Do I owe money if my call pick expires?

No, yous practise not. Yous will lose the premium you paid when y’all bought the option, but that is it.

How much do I lose if my call selection expires?

It depends on how you define “lose.” You will lose your premium paid. But there may also be an opportunity cost if your call option was

in the money

when information technology expired.

In that case, you lose ane of 2 things: the proceeds in intrinsic value on the option contract, or the gain on the asset if the selection was exercised.

Key Takeaways

- Options are the right to buy or sell at an agreed-upon strike toll for a specific flow of fourth dimension.

- Call options give the investor the option to buy at a strike price, and put options requite the investor the right to sell at a strike cost.

- Options require an choice premium. However, an pick premium gives the heir-apparent the right to purchase the underlying security and requires the seller to sell the underlying security.

- The expiration date on an option is the time menstruum in which the choice must exist exercised.

- Options can be risky, but when used accordingly, can hedge risk and diversify a portfolio.

Source: https://www.supermoney.com/options-expiration/

RosyandBo.com Trusted Information and Education News Media

RosyandBo.com Trusted Information and Education News Media